In last week’s post, I introduced the basics of Base Rent in Commercial Real Estate Leases and offered all readers a chance to grab the quick and dirty Excel Base Rent Calculator I use when the lease administration application doesn’t have that built-in functionality.

In last week’s post, I introduced the basics of Base Rent in Commercial Real Estate Leases and offered all readers a chance to grab the quick and dirty Excel Base Rent Calculator I use when the lease administration application doesn’t have that built-in functionality.

In this article, I’m going to introduce a multi-part section on Additional Rent.

What is Additional Rent?

In addition to Base Rent, tenants are usually required to pay some or all of the expenses associated with their premises including operating expenses, real estate taxes, insurance, utilities or common area maintenance (CAM). These expenses are typically fall within the definition of “Additional Rent” and they are known as “Recoveries”.

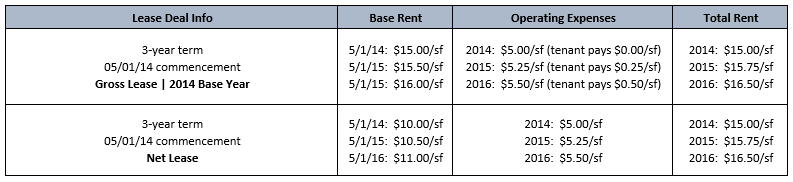

Generally, there are two classifications of leases with regard to how expenses are paid: (1) net leases, and (2) gross leases.

Net Lease vs Gross Lease

A “Gross” lease is one in which a tenant pays its share of operating expenses in excess of a certain amount. That amount can be stated as a Base Year or as an Expense Stop.

For example:

- A tenant signs a lease that states it will pay its pro-rata share of operating expenses in excess of those for calendar year 2014. If the tenant moves in on 05/01/14, it will not pay any operating expenses for the remainder of 2014. Once the landlord determines the final costs to operate the building for 2014, it will inform the tenant of that amount, which is the Base Year amount. Going forward, any operating expenses for subsequent years that exceed that dollar amount (the Base) will be due from the tenant.

- Assume it costs $5.00/sf to operate the building in 2014 (the Base Year), and it costs $5.25/sf to operate the building in 2015. Subtracting the Base Year amount from the current year amount results in the tenant paying $0.25/sf in 2015 as its share of operating expenses. If the costs to operate the building for 2016 are $4.95/sf, the tenant will not owe anything to the Landlord for that year because the Base Year expenses exceed the current year expenses. Unless written otherwise in the lease, the landlord will not owe anything to the tenant for that year.

- The Base Year amount listed in the example above was $5.00/sf. This is also known as an “Expense Stop.” A lease may state that the tenant will pay its pro-rata share of operating expenses in excess of $5.00/sf. That would be a lease with an Expense Stop.

A “Net” lease is one in which the tenant begins paying operating expenses based upon the estimate for the year of commencement without any consideration of a Base or Expense Stop amount.

- If the tenant is expected to move in on 5/1/14, the landlord will inform the tenant that operating expenses are expected to be $5.00/sf for 2014 and the tenant will begin paying that amount upon commencement. Each year thereafter, the tenant will pay the estimated amount for such year without subtraction of a Base amount.

Variations on Simple “Gross” and “Net”

- A “Full Gross” lease would be one that does not account for operating expenses. The tenant pays a base rental (with or without fixed increases) over the term. The landlord should have worked the estimated operating expenses for the term of the lease into the base rent, but assumes any risk in the event these estimates are incorrect.

- Retail leases, and some industrial leases, contain CAM (common area maintenance) expenses which are usually paid in the same manner as a Net lease, but with different terminology.

- Not usually referred to in a lease but often in conversation about leases, a deal will be referred to as a “Triple Net” Lease. Being a triple net lease simply means that the base rent does not include calculations for the three most common expenses passed along to tenants: real estate taxes, insurance and building maintenance (or operating expenses).

The difference between a “Gross” and “Net” lease is built into the tenant’s Base Rent. Net markets will often times have a lower Base Rent than a Gross market but, in the end, the landlord will be collecting the same amount.

For example:

Things to Watch for in Net vs. Gross Leases

- Two different Base Year amounts: one for Operating Expenses and one for Real Estate Taxes

- Is the Base Year a calendar year or a fiscal year? This mainly comes into play for Real Estate Taxes. Operating Expenses may be based upon a calendar year while Real Estate Taxes are based on the Fiscal Year of the taxing authority.

- Will Base Rent be reduced if operating expenses for a particular year fall below the Base Year?

- Certain items can be excluded from the Base Year only. Most likely, these would be items that are considered “unusual” and not normally incurred as part of the normal operating/maintenance of the building.A common example of this would be amortization of capital expenses. Leases usually allow the landlord to include the amortization of certain capital expenses over the useful life of the expense. Some leases allow for the exclusion of this amortization from the Base Year. To illustrate why this is done:

- Imagine a large capital project completed in 2011 with a useful life of 5 years.

- The amortization schedule for the project reflects $10,000 annually for years 2011-2016. No further amounts can be included in Operating Expenses on this project after 2016.

- A tenant moves in and has a Base Year of 2014. When determining the tenant’s Base Year expenses, the $10,000 of amortization expense is included.

- In 2017, the amortization of this project drops off but the tenant’s base year is inflated by $10,000, thus lowering the amount of expenses that the landlord can collect.

- By adding language to the lease, excluding amortization from the Base Year, the landlord protects itself from under-collecting due to artificially inflated Base Years.

- Some other items that fall into this category are: costs related to hurricanes or other natural disasters that would force the landlord to incur tremendous, unusual expense to repair the building and spikes in utility costs.

- Also, for Base Year leases, make note of the landlord’s ability to adjust the Base Year in the event real estate taxes are re-assessed.

- Often times it takes two or more years to contest a real estate tax assessment but the tenant and landlord cannot wait this long to set a Base Year and begin operating expense reimbursements. When the final decision is made by the taxing authority, the result is often a reduction in real estate taxes.

- Some leases allow the landlord to go back, reduce the Base Year and recalculate any operating expense amounts that were already determined in prior years. The tenant would then owe the landlord additional sums for prior years.

- The landlord is allowed to do this because the reduction in real estate taxes will ultimately reduce taxes for all years going forward. If the Base Year is over-inflated, the landlord will not collect the appropriate amount of reimbursements to cover the tax expenses for current years, so the Base Year needs to be adjusted proportionately.

In the next blog post, I’ll continue along the path with Additional Rent and explain how Pro Rata Share is calculated and how a simple number can change depending on the definition in use.