Another topic related to commercial real estate leases that we get asked about a lot is percentage rent. For those unfamiliar with the term, percentage rent is a type of rent primarily found in retail leases where the tenant pays the landlord a percentage of the gross sales generated from the space being leased.

Percentage Rent and Breakpoints

Oftentimes, but not all the time, the tenant doesn’t start paying percentage rent until gross sales from the location surpass a specific threshold called a breakpoint. A tenant might pay percentage rent instead of or in addition to base or minimum rent. It depends upon what’s specified in the tenant’s lease. Percentage rent is used to some degree in almost all retail categories.

By the way, in case any of the terms above are unfamiliar to you, there’s a handy, downloadable glossary in our Library that explains over 130 common commercial real estate lease terms.

Benefits of Percentage Rent for Tenants and Landlords

Percentage rent benefits both landlords and tenants. Tenants benefit because percentage rent encourages the landlord to actively maintain and promote the property to help increase the tenant’s gross sales, which in turn increases the amount of rent the landlord collects, allowing them to share in the tenant’s success and maximize rents from the property.

Percentage rent protects the tenant by keeping rent proportional to the sales generated by that location. If sales for the location drop or fall short of expectations, as happened to many retailers during the COVID pandemic, the tenant’s rent will adjust accordingly, helping them survive economic downturns.

Natural Breakpoints vs Fixed Dollar Breakpoints

As explained above, a breakpoint is a threshold or trigger specified in a retail lease that determines when a tenant starts paying percentage rent. Breakpoints are based on the gross sales from the premises, and there are two types: natural or fixed dollar.

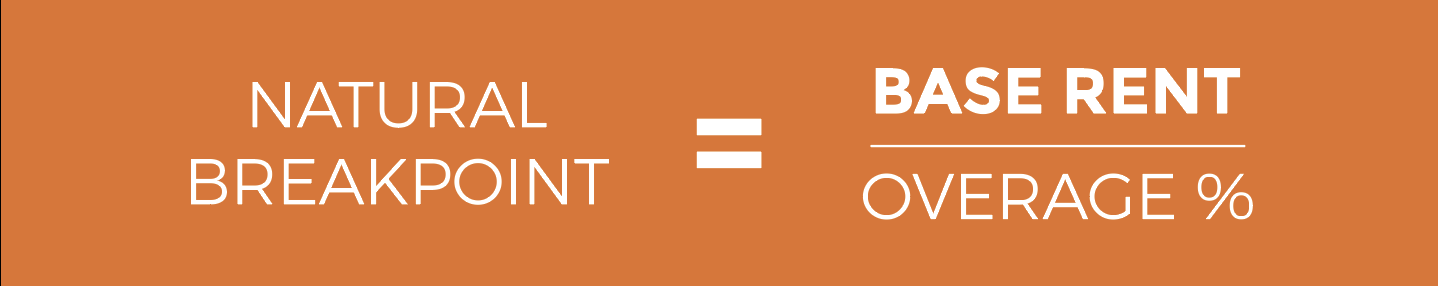

Natural breakpoints are calculated using an overage percentage, which is the percentage of gross sales over a set dollar amount that the tenant is required to pay in rent. When a natural breakpoint is used to calculate percentage rent, the overage percentage is always stated in the lease, as is the base rent.

A fixed dollar breakpoint, on the other hand, is stated in the retail lease as a straight percentage, of either total gross sales or gross sales per square foot. A fixed dollar breakpoint is determined as part of lease negotiations between the landlord and tenant.

Step By Step Instructions for Calculating Percentage Rent

Calculating percentage rent for commercial real estate is fairly straightforward, but it can be tricky initially for anyone who hasn’t done it before. We’ll walk you through the process step-by-step using the following scenario:

- Retail Tenant A signs a 10-year lease for a 10,000 square foot space in Realogic Mall, a Class A strip mall located in a Chicago suburb.

- Tenant A’s lease states that in addition to its base rent, it is obligated to pay percentage rent of 5% of its gross sales over a natural breakpoint.

- Tenant A’s base rent is $12,000 per year.

Step 1. Calculate Tenant A’s natural breakpoint.

The formula for calculating the natural breakpoint is:

So, in our scenario:

Base Rent ($12,000) ÷ Overage Percentage (0.05) =

Natural Breakpoint ($240,000)

Therefore, in addition to $12,000 in annual base rent, Tenant A will pay the landlord 5% of all gross sales exceeding $240,000 per year– the natural breakpoint.

Step 2. Verify the gross sales for the leased premises for the full year.

Generally, there are provisions in the lease for verifying gross sales. In this case, let’s say Tenant A’s lease stipulates that it shall submit monthly gross sales reports to the landlord, as well as an end-of-year report showing gross sales for the full year. The reports confirm that gross sales for the premises for the full year were $425.000.

Step 3. Subtract the natural breakpoint from total gross sales to determine the dollar overage that is subject to percentage rent.

Per our scenario:

Gross Sales ($425,000) – Natural Breakpoint ($240,000) =

Dollar Overage ($185,000)

Step 4: Multiply the dollar overage by the overage percentage stated in the lease:

Dollar Overage ($185,000) x Percentage Overage (.05) =

Percentage Rent ($9,250)

So, Tenant A owes the landlord $9,250 in percentage rent for the first year of its lease.

Click and Collect Purchases: Include in Gross Sales or Not?

The popularity of so-called Click and Collect purchases, where a consumer buys something online through a company’s web site but picks it up at a physical store rather than having it shipped, has soared in recent years, driven by both changing consumer shopping habits and the COVID pandemic. In the first quarter of 2020, about 1/3rd of US consumers made a Click and Collect purchase, up from 28% in Q1 of 2019.

Naturally, with Click and Collect purchases accounting for a growing percentage of retailers’ sales, landlords want them included in Gross Sales figures used for Percentage Rent calculations. Tenants of course do not because higher Gross Sales translate to higher rent.

Landlords are increasingly using the point as a bargaining chip, agreeing to shorter-term leases or to restructure leases in exchange for retailers including Click and Collect or even full omni-channel sales in their Gross Sales figures for Percentage Rent. In fairness to retail tenants, if Click and Collect sales are to be included in Gross Sales, then returns and exchanges of those purchases should be factored in too. Some retail tenants are coaxing generous concessions from landlords in exchange for including online or mobile sales in Gross Sales, including the option to terminate a lease if sales at a location drop below a certain threshold for a certain period of time.

The debate over whether receipts from Click and Collect and omni-channel purchases should be included in Base Rent is bound to continue as the number and dollar amount of Click and Collect, online and mobile purchases made by consumers continues to rise.1

Some Final Thoughts on Percentage Rent

- Anytime Base Rent changes, so does the natural breakpoint.

- If a tenant is paying percentage rent using a fixed dollar or dollar per square foot breakpoint, rather than a natural breakpoint, those breakpoints will be specified in the tenant’s lease.

- Breakpoints can be cumulative and payment periods can vary. Both are typically addressed in the lease.

- Landlords may be entitled to recapture expense recoveries against percentage rent. If so, it will be stated in the lease.

- Breakpoints can be tiered, so the overage percentage changes as sales increase.

- Certain goods and services may be excluded from gross sales tabulations. In addition, different categories of goods and services may have different overage percentages. For example, a convenience store may have a different overage percentage and thus a different percentage rent for food as opposed to lottery tickets or magazines

Additional Information on Commercial Real Estate Leases

If you’d like more information on commercial real estate leases, there are posts in our blog on:

In addition, we offer two immensely popular training courses on commercial real estate leases– Understanding Commercial Real Estate Leases and Lease Abstraction.

Commercial Real Estate Lease Administration

Or, if you’d like some helpful information on administering commercial real estate leases, including expert tips, help and best practices, there are several posts on that subject in our blog as well. Those posts include:

- 11 Costly Errors in CRE Leases and How to Avoid and Rectify Them

- Lease Administration for Troubled Assets

- Lease Administration Best Practices- Part 1: Subleasing

- Lease Administration Best Practices- Part 2: Encumbered Space

- Lease Administration Best Practices- Part 3: Letters of Credit and Storage Space

Expert Help with Your Lease Administration

If you could use some expert help administering your leases, the Realogic team has decades of experience and currently administers leases for over 130 MSF of commercial space. For more information on Realogic’s full suite of lease administration services, visit the lease administration page on our website or contact us at info@realogicinc.com or 312-782-7325.

About The Author

Terry Banike is Vice President of Marketing for Realogic. Over the course of his career, he has worked in marketing, communications, journalism and public relations, and has written news stories and features for newspapers, trade publications, newsletters and blogs. A rabid reader of anything and everything on commercial real estate, Terry closely follows commercial real estate news and trends and frequently posts about real estate on the Realogic Blog. He can be reached at tbanike@realogicinc.com.

Sources:

1- Click and Collect Retail Sales In The United States from 2020-2025; Statista

Note: This post was updated with new information in December 2024.