While reviewing thousands of our clients’ Argus Enterprise (“AE”) models every year, we notice a wide variety of issues, mistakes or perceived lack of understanding about how Argus Enterprise functions. At Realogic, we use a variety of review methodologies to ensure accuracy and model calculation clarity, including checklists, double blind reviews, Excel-based, formula-driven reporting and external calculations of portfolio, property and tenant-level results. This post is the first in a series on Argus Enterprise file review best practices. These posts will highlight nuances discretely buried within the Argus Enterprise files. Our initial review topic, Market Rent Inflation, is a topic that on the surface seems simple, yet can be quite nuanced.

The Five Most Essential AE Input Areas to Review

Any Market Rent Inflation review should encompass at least the following five Argus Enterprise input areas:

- Modeling Policies

- Property > Description

- Market > Inflation

- Market > Market Leasing

- Market > Market Rent

Argus Enterprise Modeling Policies

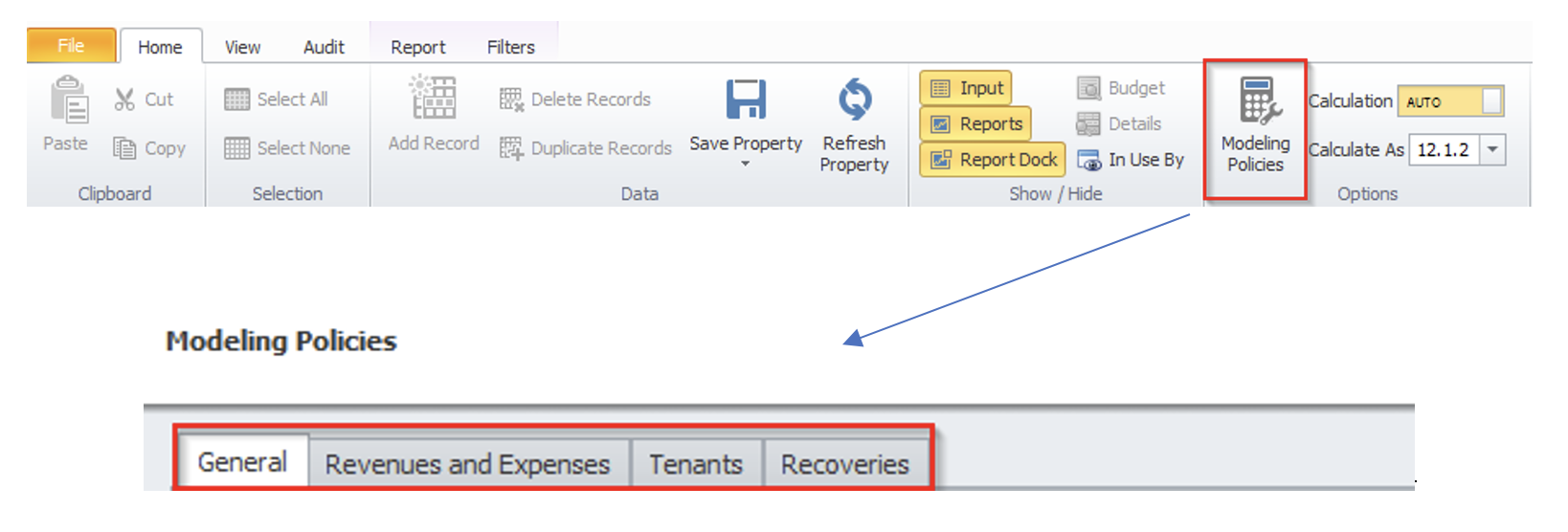

Any initial review of inflation methodologies must start by reviewing the AE “Modeling Policies”, which are found in the Argus Enterprise menu bar as seen in the image below.

Once the user clicks on Modeling Policies, the following tabs are available:

- General

- Revenues and Expenses

- Tenants

- Recoveries

These tabs allow the user to specify set defaults that will determine calculation methodologies.

Inflation

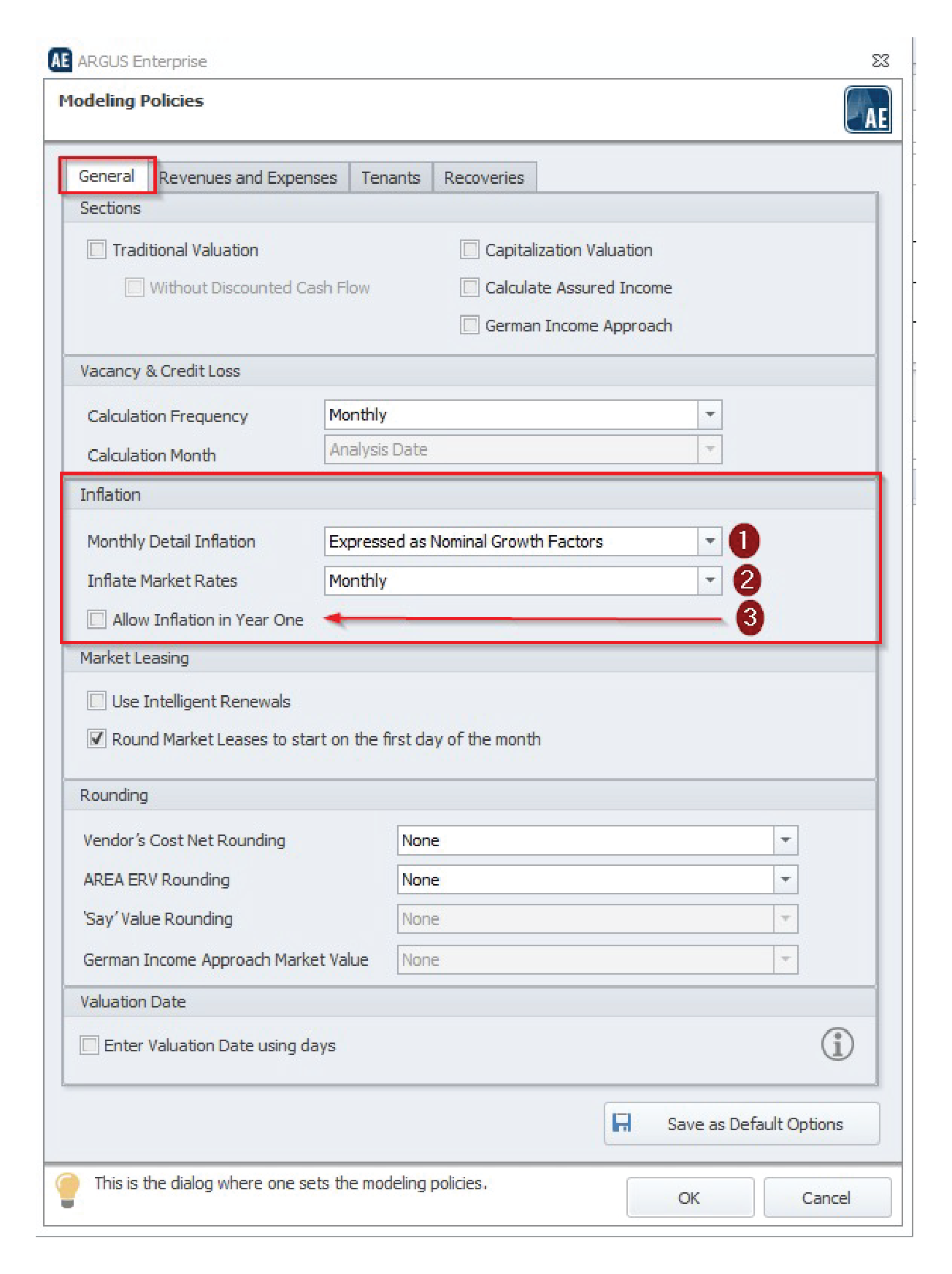

The Inflation section of the General tab is likely to be familiar to most Argus Enterprise users. There are three options within the Inflation Section of the General tab that users need to be aware of:

Monthly Detail Inflation

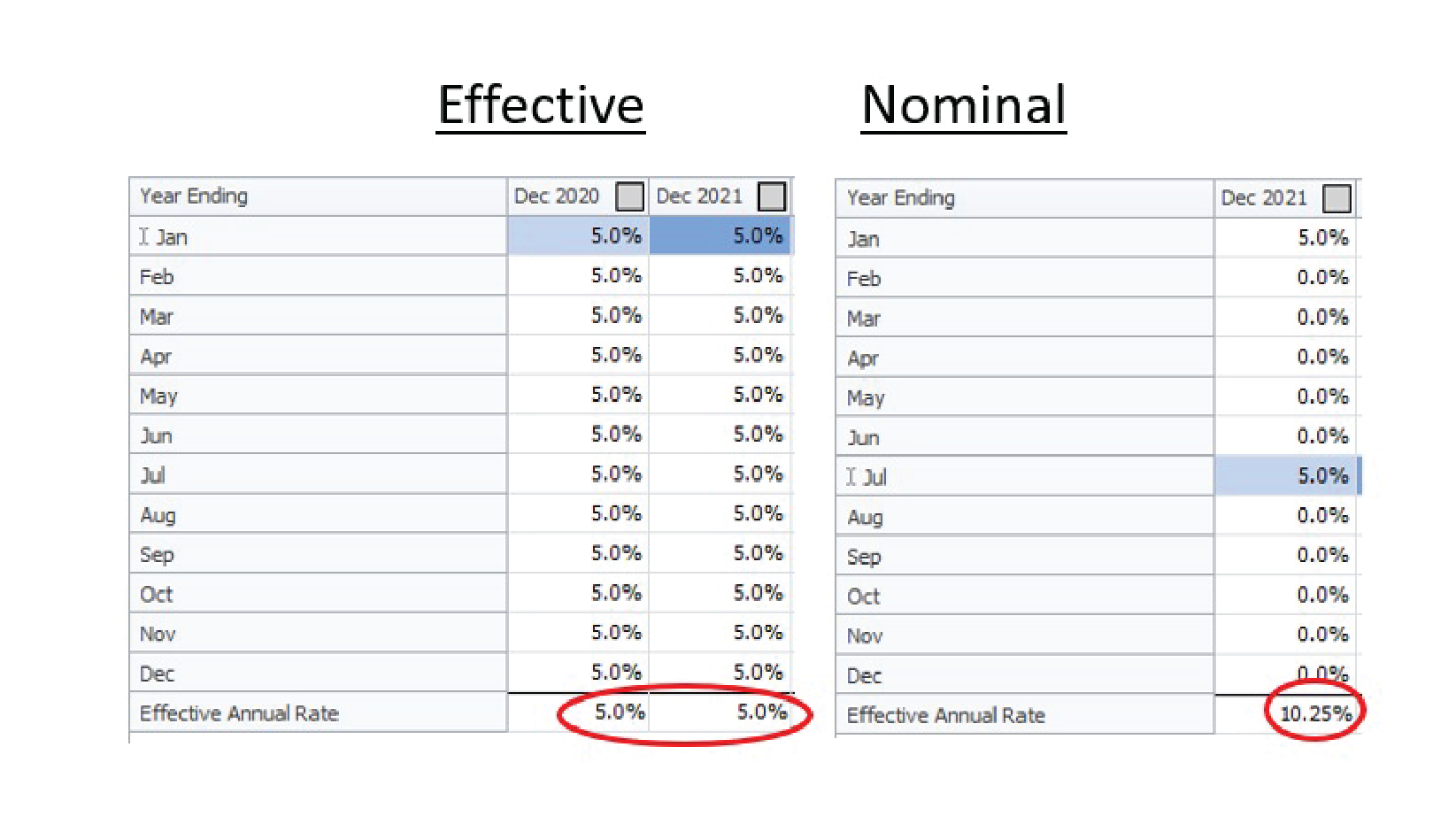

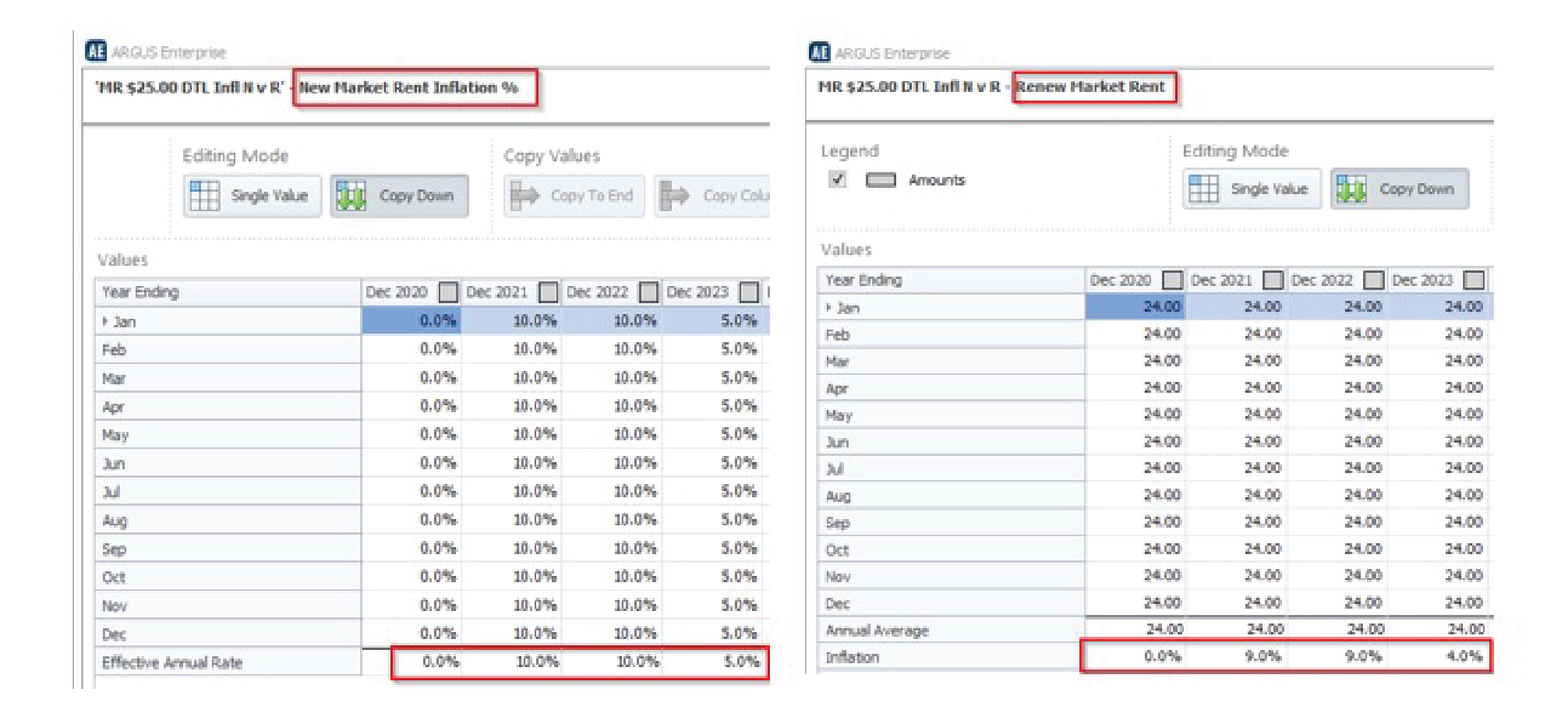

The user selects whether inflation is expressed as Nominal Growth Factors (varying monthly rates entered in the Monthly Detail grid are compounded monthly and displayed as a single Effective Annual Rate), or Annual Effective Growth Rates (varying monthly rates entered in the Monthly Detail grid are averaged over the year and displayed as a single Effective Annual Rate).

Inflate Market Rates: Annual or Monthly inflation.

Allow Inflation in Year One: When checked, the inflation column is available for the first year of the analysis.

If users are not aware of the methodology selected in the Monthly Detail Inflation dropdown, it is easy to over or under inflate from your intended result. Fortunately, Argus will display the Effective Annual Rate at the bottom of the input screens.

Please note that selecting “Expressed as Annual Effective Growth Rates” automatically enables Year 1 inflation and Year 1 is no longer grayed out as in the “Expressed as Nominal Growth Factors” option. The user should check the option selected and review any monthly input of inflation to confirm that it matches the desired Effective Annual Rate assumption.

Market Rates Inflation

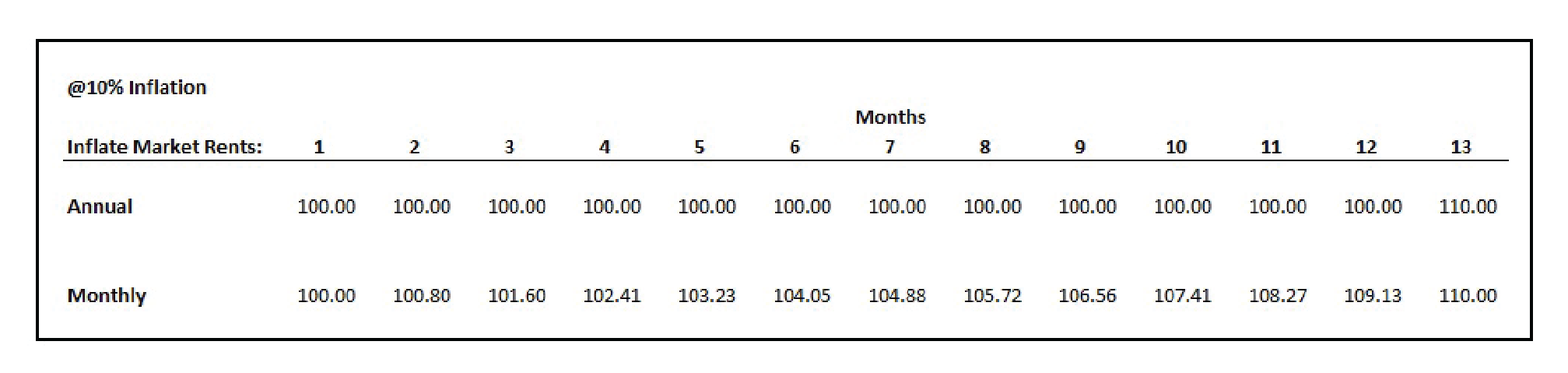

The second option is probably the most familiar to Argus Enterprise users, and it determines whether market rents are inflated monthly or annually. Remember that in the real world, there is no magic date on which market rents inflate. January of every year does not automatically move market rates up or down, nor does the start or end of any given month. These dates are estimates of what inflation will look like over time. The key takeaway is to understand the impact of inflating market rents annually or monthly so you can choose the underwriting assumption that best fits your forward-looking view of the market.

The MONTHLY selection is more aggressive as annual rates increase incrementally monthly instead of once per year, as evidenced by the bottom line in the chart below. ANNUAL, as the first row indicates, inflates market rents once every 12 months, with no growth in between. Consider the impact of a speculative lease commencing in month 12 in both scenarios. The difference in the month 12 market rate is almost $10.00 per square foot in the example below.

Note: 10% Factor converted = (1.1) ^ (1/12) = 1.00797.

Though there is no standard selection, and your selection should reflect your views of the marketplace, it has been our experience that the ANNUAL selection is more common.

Allow Inflation in Year One Option

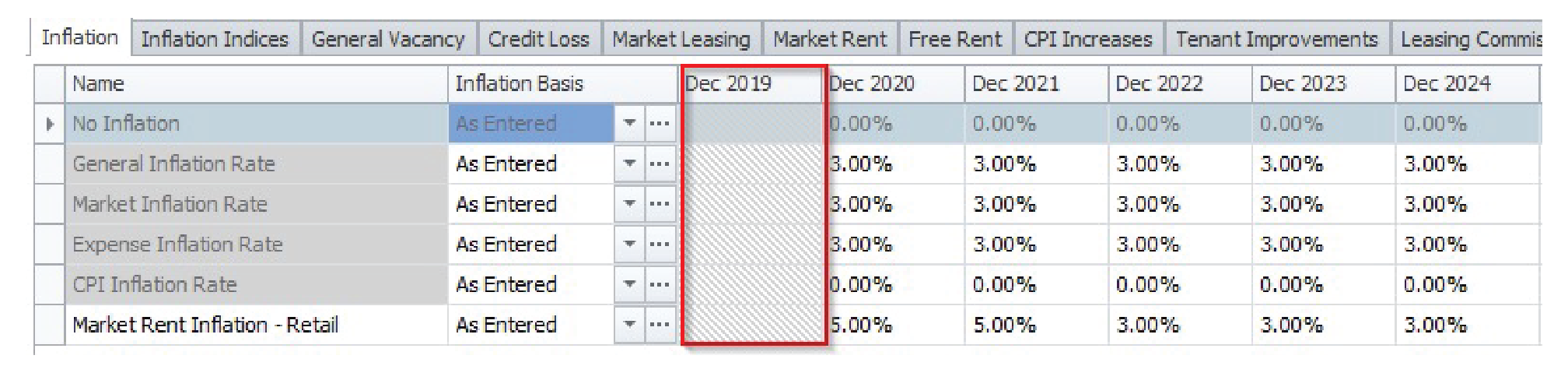

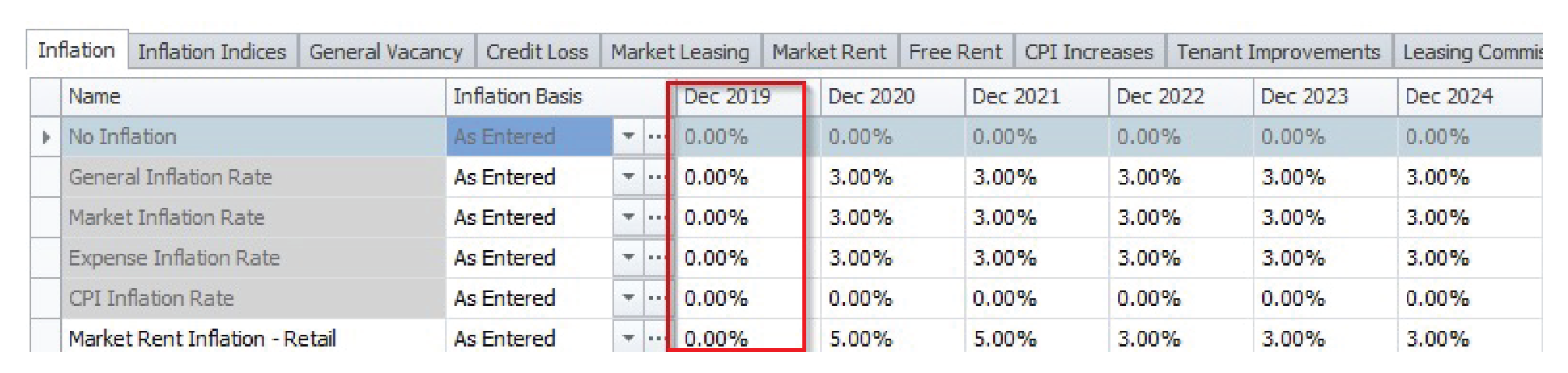

The third option, “Allow Inflation Year 1,” is literal. When this option is checked “on”, the inflation column in the Market Inflation tab is enabled for the first year of the analysis, as seen in the input screens below. The modeling difference is subtle, but the result can be impactful. The same $100 entered in the prior chart with the same 10% growth rate would increase rent to $110 in month one of the analysis, potentially resulting in an undesired result.

Allow Inflation Year 1 Not Checked: User Input is disabled for Year 1 of Analysis.

Allow Inflation Year 1 Checked: User Input is enabled for Year 1 of Analysis.

After you complete your review of the Modeling Policies in Argus Enterprise, there is an additional “background” item you should review: the Property > Description tab.

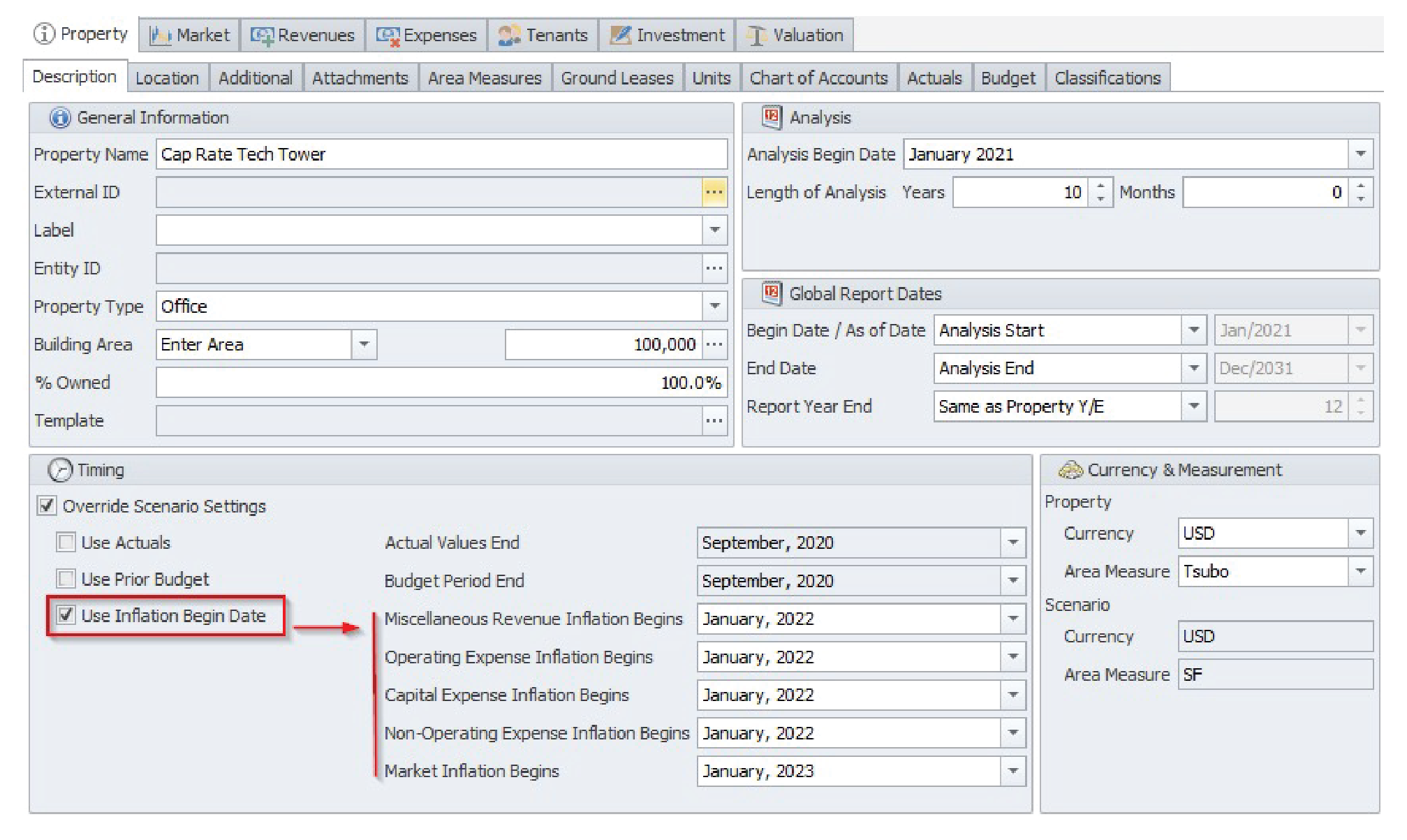

Property > Description Tab

As seen in the picture above, the Property > Description tab in Argus Enterprise includes global overrides of Inflation Begin Dates for five categories, including Market. These overrides are commonly used when the Analysis Begin Date is several years in the past, and they assist with the management of Inflation without having to push the file forward to a new Analysis Begin date or pad the inflation inputs with zero growth for historical years. Now that we have laid the preliminary groundwork for the review, we can move onto detailed reviews of the market screens in Argus Enterprise. The Market > Inflation Table is our next destination.

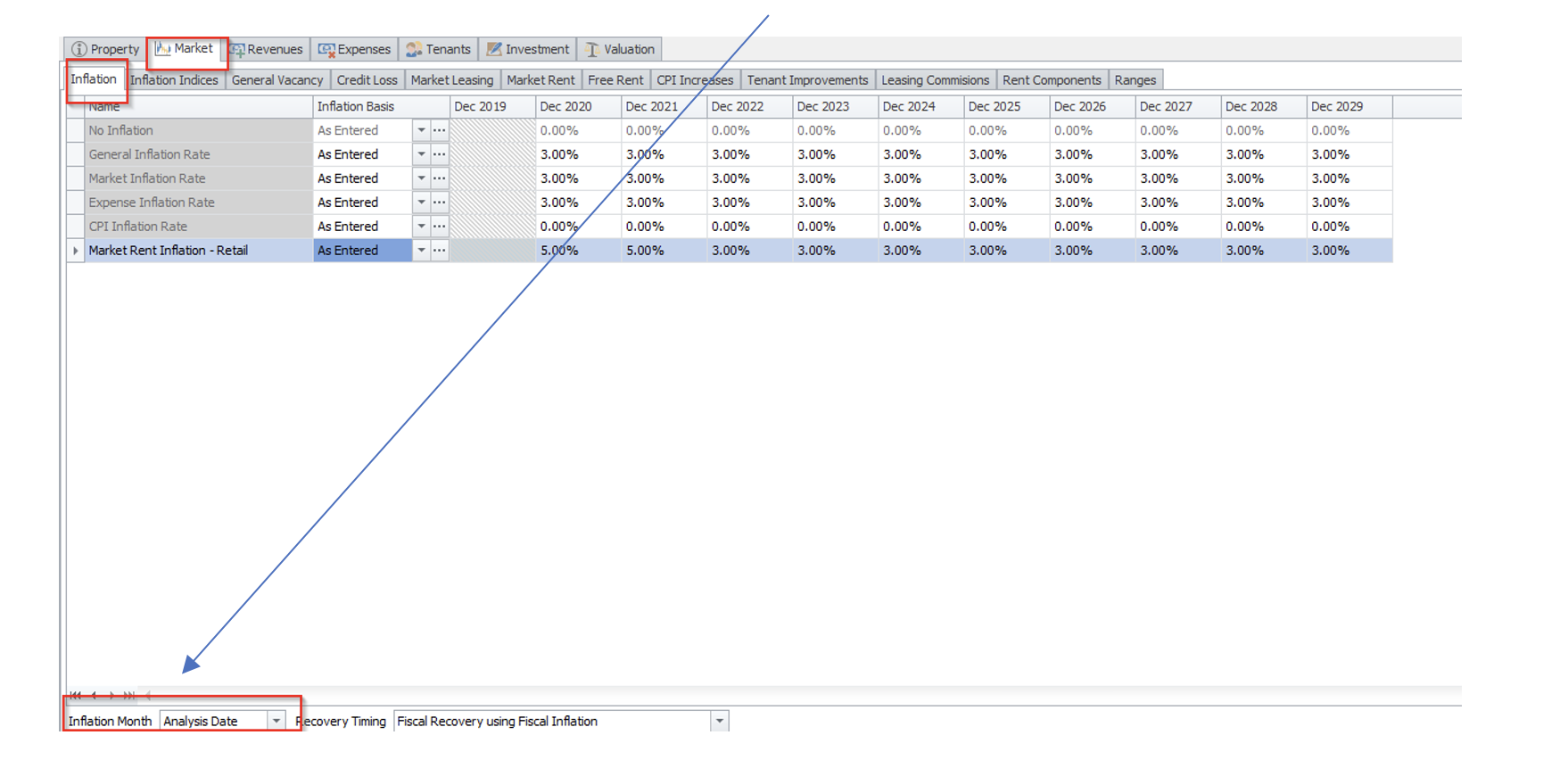

Market > Inflation Table

The user should first check and note the Analysis Begin Date found in the Property > Description table. The Analysis Begin Date is typically the first date of all inputs and anchors when inflation will occur on subsequent anniversaries. However, this is not necessarily true. A second input to check is the Inflation Month, which is found below the Market > Inflation menu selections.

The Inflation Month drop down allows users to pick any month or the Analysis Date for the increase to occur. For example, a 1/1/2021 Analysis Date and an Inflation Month of April would begin the inflation growth the first time the model encounters the April date, which is three months into the Analysis.

The third and fourth areas to check in Argus Enterprise are Market > Market Leasing and potentially the Market > Market Rent screen. In each of these input areas, users can override global inflation rates and set them specifically to that record. Let’s take a closer look:

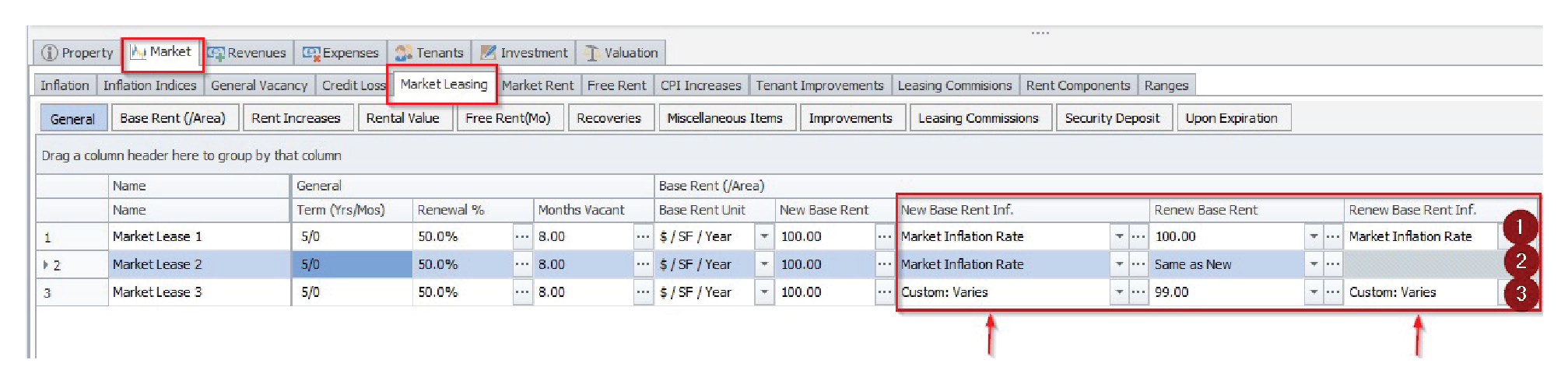

Market > Market Leasing Table

If both New and Renew rates are entered as in lines 1 and 3 above, the user must inspect two inflation rates, one for each component (New and Renew).

The end user can select either an Inflation Rate previously created or create a custom inflation.

The Inflation Rates or Custom Rates entered are NOT required to match.

If the Renew Market Rent is set to “Same As New”, only the New Market Rent Inflation needs to be checked.

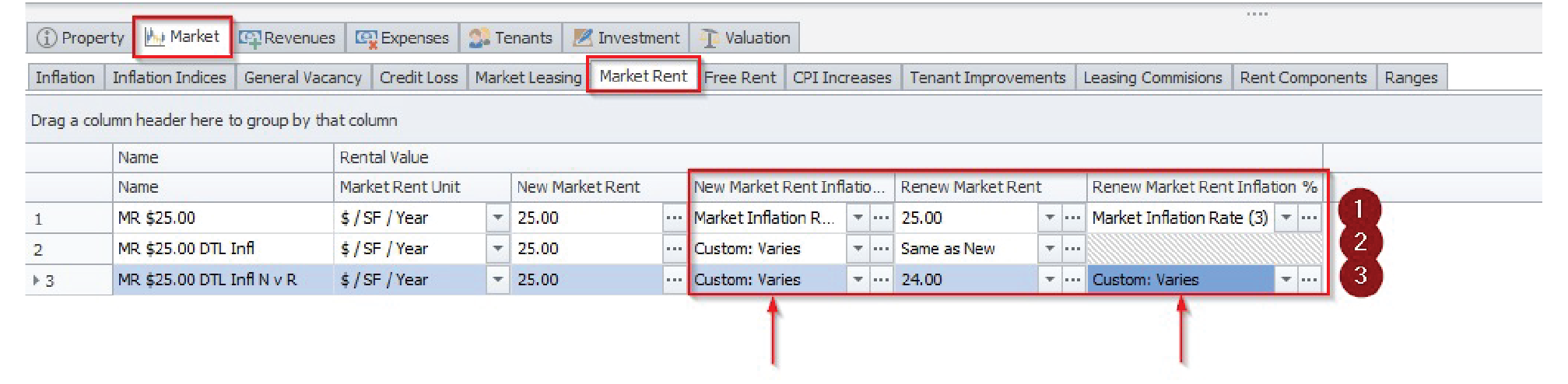

Market > Market Rent Tab

As you can see from the picture below, there are several alternatives to entering inflation rates that you must review:

If both New and Renew rates are entered as in lines 1 and 3 above, the user must review two inflation rates, one for each component (New and Renew).

The end user can select either an Inflation Rate previously created or create a custom inflation.

The Inflation Rates or Custom Rates entered are NOT required to match.

If the Renew Market Rent is set to “Same As New”, only the New Market Rent Inflation need be checked. There is potentially a fifth area to review. However, this applies only if market rates are being modeled at the individual tenant record within the Rent Roll Screen. We will be covering that particular methodology in a future post regarding occupancy cost underwriting for retail assets.

Use Argus Enterprise Reports to Validate Results

There is no substitute for a physical review of the market rent inflation inputs in Argus models. While there are many areas to inspect, a physical review of the inputs may alert the end user to potential issues.

We realize errors can happen and simply conducting a visual review of inputs may not catch all of them. To further mitigate these errors, we recommend that Argus Enterprise users consider some automated routines to further inspect the calculated results. For instance, processing the calculated results via Excel can be an effective measure.

Realogic’s team uses two Argus Enterprise reports to validate our physical review of rental growth assumptions: 1) The Assumptions report, which presents the market data as a time-series, and 2) the Lease Audit report, which shows the market rent impacting each row in the Argus Enterprise Rent Roll. Running both reports, presented on a monthly basis, from the Analysis Start date will create Excel worksheets that can be vetted with formulas for growth begin, annual or monthly growth rates, as well as a compounded annual growth rate. Additionally, these reports can be run across many assets via Report Packages, adding scale and speed to your review process.

If we were to leave you with one piece of advice, it would be to utilize a “belt and suspenders” approach to reviewing your Argus Enterprise files. In our experience, and in the case of Market Rent Inflation, a combination of physical review and reports-based automation is most effective to fully understand the Market Rent Inflation nuances within AE.

Help With Your Argus Enterprise Files

Over the past 29 years, Realogic has built and reviewed thousands of Argus Enterprise files on behalf of our clients. If you’d like help building or auditing your AE models, reach out to us at info@realogicinc.com. In addition, we offer beginner and advanced level classes in commercial real estate modeling with Argus Enterprise. For more information on all of our commercial real estate training courses, click here.

By Jim Pettinger, CEO, Realogic and Steve Waryas, Vice President, Realogic