The return of Donald Trump to the White House brings a new set of policy shifts that could significantly reshape the commercial real estate (CRE) landscape. Industry surveys indicate that an overwhelming majority of real estate investors expect the election outcome to directly impact their business strategies. Trump’s agenda emphasizes tax cuts, deregulation, infrastructure investment, and protectionist trade measures – all of which carry both promise and peril for commercial real estate stakeholders.

How Trump’s Policies Might Impact Commercial Real Estate

This report examines key policy areas under the new administration and analyzes their potential impact on major property types, namely office, retail, industrial, and multifamily. We consider both the opportunities, such as investor-friendly incentives and economic growth catalysts, and the risks, including higher costs and market disruptions, drawing on expert forecasts and early indications from policy proposals.

Trump Taxation Policies and CRE Investment Impact

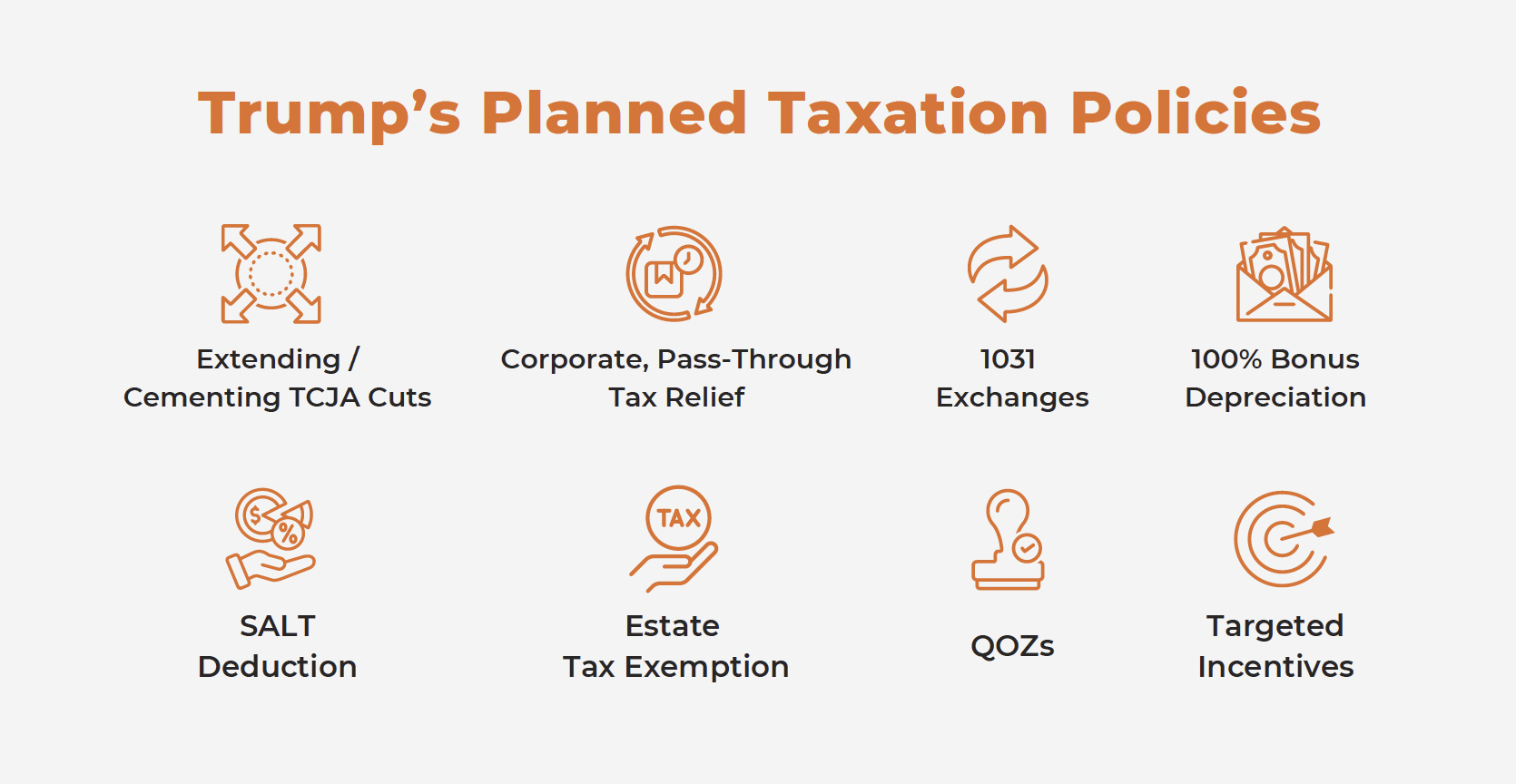

Trump’s tax agenda is poised to be highly investor-friendly, building on the 2017 Tax Cuts and Jobs Act (“TCJA”) and introducing new incentives. Key proposed changes include:

- Extending or Making Permanent the TCJA Cuts: Many provisions of the TCJA are set to expire at the end of 2025, but Trump and a Republican-controlled Congress are likely to push for extending and even enhancing those tax cuts. This would avoid automatic tax hikes in 2026 and maintain lower tax rates on businesses and individuals. In particular, Trump has voiced support for renewing and expanding the TCJA in his second term.

- Corporate and Pass-Through Tax Relief: Proposals call for reducing the corporate tax rate from 21% to 15% and preserving favorable treatment for real estate pass-through income. The Qualified Business Income (“QBI”) deduction– a 20% pass-through deduction– enacted under TCJA could be extended, allowing many property owners to continue applying low corporate rates to their rental profits, effectively.

- 100% Bonus Depreciation: The TCJA’s 100% bonus depreciation began phasing down after 2022. Trump proposes to restore full expensing for capital investment. For commercial real estate, this means investors and developers could immediately write off building improvement costs, renovations, and certain property purchases, boosting after-tax returns and encouraging capital expenditures.

- State and Local Tax (“SALT”) Deduction and Estate Tax: The $10,000 SALT deduction cap could be removed, as Trump has suggested eliminating the cap entirely. This would most benefit high-income investors in high-tax states, potentially increasing their capacity to invest in real estate. Additionally, making the higher estate tax exemption permanent– rather than letting it expire in 2025– is on the agenda, which would help wealthy real estate owners pass down properties without forced sales for tax reasons.

- Opportunity Zones and 1031 Exchanges: Programs like Opportunity Zones, created in Trump’s first term to spur investment in distressed areas, are expected to be extended or expanded. Likewise, the 1031 like-kind exchange rules are likely to remain intact; Trump’s platform explicitly supports maintaining 1031 exchanges for real estate. These measures preserve important tax-deferral tools for property investors.

- Targeted Incentives: New niche incentives are under consideration. For example, a Revitalizing Downtowns Act has been proposed to offer tax credits for office-to-residential conversions. This could unlock significant value in underutilized office buildings by making conversion projects financially viable, helping address the office glut and housing shortages simultaneously.

Opportunities For Commercial Real Estate

These tax policies collectively signal a continued pro-growth, pro-investor climate in real estate. By keeping taxes low on capital gains, rental income, and development costs, the administration aims to invigorate smart capital flows into property markets. More favorable depreciation and tax credits could encourage new development and redevelopment (e.g. upgrading older offices or new construction in Opportunity Zones). Lower pass-through and corporate taxes improve net operating income for property owners and REITs, potentially lifting valuations.

In short, CRE investors may see a range of favorable policies, including lower taxes on capital gains and income, expanded opportunity zones, and maintained 1031 exchanges, which underscore the importance of proactive tax planning to take advantage of the shifting landscape.

Risks For Commercial Real Estate

The benefits of tax cuts come with some caveats. Major tax reductions could widen federal deficits, and funding these cuts may require offsetting measures. Industry experts warn that extending the TCJA without revenue offsets adds pressure to the national debt. This raises the possibility of future fiscal crunches or upward pressure on interest rates. Additionally, to pay for tax relief, other programs might face cuts. For instance, federal support for green energy and efficiency, such as credits for solar panels, EV chargers, or energy-efficient building upgrades, might be reduced or repealed.

Real estate owners in states with strict building performance standards rely on federal grants and credits to meet those mandates; loss of this support could make compliance more costly. There’s also uncertainty around which tax changes will actually pass. Any legislative deadlock could delay or dilute the intended benefits. CRE decision-makers rank tax policy changes as a top concern for 2025 given this uncertainty, so they will need to stay agile and informed on Capitol Hill developments.

Deregulation Efforts and Effects on Commercial Real Estate Development and Financing

Trump’s administration is moving swiftly to roll back or rewrite regulations, aiming to reduce barriers for businesses, including real estate developers and lenders. Key deregulatory moves and their implications are:

Freezing and Repealing Regulations: On Day 1, Trump signed an executive order freezing all pending federal regulations, pausing new rules until his team can review them. This 60-day freeze on late-stage Biden-era rules means certain environmental, financial, and labor regulations may never take effect. The administration will likely discard or rewrite rules seen as burdensome to industry. For commercial real estate, this could include relaxing environmental reviews and easing building efficiency mandates, thereby shortening approval timelines.

Indeed, Trump has explicitly pledged to roll back environmental and building regulations that hinder housing construction. His HUD nominee has similarly vowed to cut regulations that are stifling development to accelerate housing projects. Less red tape in zoning, permitting, and environmental clearance can reduce development costs and delays.

Streamlining Permitting: A major complaint of commercial real estate developers is the slow permitting process for large projects. The Trump administration is tackling this by invoking emergency powers and fast-tracking certain projects. For example, Trump declared an “energy emergency” to use the Defense Production Act to speed up permits for energy infrastructure, including oil and gas pipelines and refineries.

By analogy, we can expect faster approvals for commercial real estate projects deemed economically important, and a more favorable review of large-scale developments. This could particularly help industrial and logistics projects, such as warehouses and factories, and large residential communities, which often face lengthy environmental reviews.

Financial Deregulation and Credit Access: In the financial sector, the administration is signaling a lighter touch that could improve credit availability for CRE deals. One example is the potential softening of bank capital requirements under the Basel III “Endgame” rules. The current proposal might be reproposed with a capital-neutral approach, which would avoid raising banks’ capital charges for real estate loans.

Loosening such requirements can boost liquidity and lending capacity in the banking system, making it easier for developers and investors to obtain financing. Similarly, regulators may ease up on scrutiny of commercial real estate loans to encourage banks to refinance or restructure loans instead of foreclosing. This is a welcome change for a sector that faced a credit squeeze in 2023-24.

Housing and Land Use Deregulation: While zoning is mostly local, the federal government is leveraging its influence to spur housing development. Bipartisan momentum is growing for looser zoning and higher density to combat housing shortages. The Trump administration may encourage this by tying federal infrastructure dollars to relaxed local zoning rules. By incentivizing cities to allow more multifamily development– for instance, up-zoning single-family areas or repurposing commercial sites– the administration can indirectly expand housing supply. This approach could create opportunities for developers to undertake more apartment and mixed-use projects in markets previously constrained by strict zoning.

Privatization of Housing Finance (Government Sponsored Enterprise or “GSE” Reform): A significant policy shift on the table is the privatization of Fannie Mae and Freddie Mac, the government-sponsored enterprises critical to multifamily and single-family mortgage finance. Trump’s team has revived plans to privatize the GSEs, with a nominee in place at the Federal Housing Finance Agency who supports this direction. If Fannie and Freddie reduce their role or raise pricing to become fully private entities, the cost of debt for multifamily properties could rise.

These GSEs currently underpin a huge portion of apartment lending, especially for affordable and workforce housing, by providing low-rate, government-backed loans. Industry observers warn that privatization would cause a significant spike in the cost of buying a home for Americans, and by extension it could increase apartment financing rates as well. This poses a risk for multifamily developers and investors, who may face higher interest rates or stricter terms on loans if GSE guarantees diminish. On the other hand, a privatized system might spur more competition and innovation in lending over the long term, albeit with less of a government safety net.

Labor and Immigration Policies: Another quasi-deregulatory stance is stricter immigration enforcement, which is not typically framed as deregulation, but does intersect with commercial real estate development by affecting labor availability. Trump’s plans for more aggressive deportations could worsen the construction labor shortage, since over 25% of U.S. construction laborers are immigrants.

The construction industry is already short nearly 500,000 workers, and removing workers will drive up labor costs and slow project timelines. CRE projects, especially housing and infrastructure, may face higher bids and delays if the workforce is constrained. Thus, while deregulation reduces paper hurdles, labor scarcity could become a bottleneck for development – a risk factor for delivering new office, industrial, and residential projects on schedule.

Opportunities For Commercial Real Estate

The broad deregulatory thrust is positive for development and investment activity. Easing environmental rules and accelerating permits lower the time to market for new construction, directly benefiting developers of all property types. For example, simplifying wetland and endangered species regulations can expedite building industrial facilities or master-planned communities. Reducing building code stringency or certain design mandates can cut construction costs, improving project viability.

In the financing realm, if banks face a friendlier regulatory environment, they may extend more credit to CRE borrowers, helping to refinance maturing loans or fund new acquisitions. This is especially important as tighter monetary policy had made lenders very cautious; a bit of regulatory relief could grease the wheels of CRE transactions.

Additionally, aligning federal incentives with deregulation, like tying infrastructure funds to zoning reform, could unlock development sites for multifamily housing that were previously off-limits, addressing supply shortages and creating new investment opportunities. Overall, Trump’s pro-business stance and rollback of hurdles are expected to make it easier for developers to obtain permits, reduce project timelines, and lower costs.

Risks For Commercial Real Estate

The flip side of deregulation is policy uncertainty and potential long-term costs. Constantly changing rules can make it hard for CRE professionals to do long-range planning. For instance, environmental compliance standards might shift dramatically, causing confusion in project design. Moreover, rolling back regulations could incur future liabilities or public pushback. If environmental safeguards are loosened too much, projects might face litigation from states or advocacy groups or suffer reputational damage.

In the financing sector, easing bank regulations too far raises concerns about financial stability. An overly lax environment in commercial lending could lead to riskier loans and higher defaults down the line– a repeat of past cycles. For housing finance, the uncertainty around Fannie/Freddie reform may disrupt multifamily capital flows until a clear path is set; developers might delay projects if they fear loan availability will tighten.

Lastly, the beneficial effects of deregulation could be undercut by external factors like labor shortages (as noted) or rising material costs. In summary, fewer regulatory barriers help CRE in the near term, but industry leaders must weigh execution risks: not all deregulatory promises will materialize smoothly, and some changes, like GSE privatization, could introduce new challenges for certain sectors.

Interest Rate Trends and Their Influence on CRE Values and Deals

Interest rates are a critical factor for commercial real estate, affecting everything from property valuations to deal volume. Over the past two years, CRE has been buffeted by rapidly rising interest rates as the Federal Reserve fought inflation. Higher borrowing costs have already pushed down commercial property values by an estimated 22% from their early-2022 peak and made refinancing much more challenging. Looking ahead, the Trump administration’s policies and influence on the macroeconomy will help shape the trajectory of rates and thus the fortunes of commercial real estate investors.

Current Environment and Short-Term Outlook: The good news for CRE is that the Fed has shifted course and began cutting rates in late 2024. There were three consecutive rate cuts last year, trimming the benchmark rate by about 1 percentage point. More cuts are anticipated in 2025 as inflation shows signs of moderating. Deloitte’s economists project the Fed’s target rate could fall to around 3.75–4.0% by end of 2025 in their baseline scenario. Indeed, Trump himself has long favored lower interest rates and is expected to pressure the Fed toward an easier monetary stance, though the Fed remains independent in its decisions.

Lower interest rates would be a tailwind for CRE: financing costs would drop, making it easier for investors to borrow for acquisitions or development. Cheaper debt also boosts what buyers can pay, which in turn supports property valuations. If cap rates, which often are correlated with interest rates, compress again, asset values for office, retail, industrial, and multifamily properties could stabilize or rise. The transaction market, which slowed dramatically under high rates, might pick up as buyers and sellers find more common ground on pricing. In short, an environment of falling or low interest rates would encourage borrowing and expand investment in commercial properties.

Refinancing Risk: A major challenge looming over the industry is the coming wave of over $2.75 trillion of commercial mortgage loan maturities due in the next few years. Many of these loans were originated when interest rates were near historic lows. Refinancing them now, at much higher rates, is difficult because the new debt service might exceed property incomes.

If interest rates continue to decline in 2025, it will provide relief for borrowers needing to refinance or extend loans. However, if rates were to remain elevated, more borrowers will face shortfalls and be unable to get a large enough loan to pay off the old one. This could force property sales or even defaults, especially in sectors already under strain like older office buildings and some retail centers.

The hope is that by the end of 2025 or early 2026, the rate cuts will have filtered through, easing the refinance crunch. Many lenders and owners are cautiously optimistic that the sector’s rebound will continue as financing costs abate. But lingering inflation is a wild card. It could push up long-term rates, like the 10-year Treasury yield, which underpins commercial mortgages, and complicate the recovery.

Trump Policy Impact – Inflation vs Growth: The Trump administration’s policies can influence interest rate trends in conflicting ways. On one hand, tax cuts and infrastructure spending could stimulate economic growth, which might allow rates to stay lower without reigniting inflation, especially if productivity improves. On the other hand, aggressive trade tariffs or fiscal expansion could add to inflationary pressures, which might make the Fed hesitate or even reverse course on rate cuts.

Economists warn that steep import tariffs act like a tax on consumers, potentially reigniting inflation and leading to higher interest rates than otherwise expected. Deloitte similarly cautions that if new tariffs boost inflation, the Fed could pause its rate-cutting cycle, delaying meaningful relief for commercial real estate debt markets until well into 2026 or 2027.

In essence, Trump’s pro-growth agenda is a double-edged sword for interest rates: it aims to lower them via Fed pressure and improved business conditions but carries inflation risks that could keep rates higher for longer.

Differentiated Impact by Commercial Property Type

All major property types benefit from lower interest rates, but some need it more urgently than others:

- Office: The office sector is in the midst of a value reset due to remote work. Higher interest rates have exacerbated office pain by driving values down further and making refinancing difficult. Class B/C offices in particular are at risk of loan defaults. Any rate relief could help stabilize the office market and, coupled with conversion tax credits, enable more adaptive reuse. Top-tier office properties– “trophy” assets– might see renewed investor interest as financing becomes cheaper. Some investors are already eyeing high-end office projects as tenants gravitate to quality space. However, the sector’s recovery hinges not just on rates, but on absorbing excess space, which is a slow process.

- Retail: Many retail properties have relatively stable cash flows, but tenants and consumers are sensitive to interest rates indirectly. High rates squeeze consumer credit and spending, hurting retail sales. If rates ease and tax cuts put more money in consumers’ pockets, retail landlords could see stronger tenant sales and demand for space.

However, if inflation spikes due to tariffs and forces rates up, shoppers may pull back, impacting retailers’ health. The net effect on retail commercial real estate will depend on maintaining a balance of low borrowing costs and healthy consumer confidence.

- Industrial: Industrial and logistics real estate has been a star performer, driven by e-commerce and supply chain reconfigurations. It weathered the rate hikes relatively well, as vacancies stayed near record lows in many markets. Nonetheless, high interest rates did cool the torrid investment sales activity in industrial, and development starts have slowed as financing costs rose.

A decline in rates will likely reignite warehouse investment and development because the demand drivers– e-commerce, inventory build-up, and manufacturing growth– are still strong. Indeed, industrial warehouses are poised to stand out in 2025, with fundamentals expected to remain solid. Lower cap rates would keep pricing elevated for logistics assets. The main concern is if long-term rates stay high due to inflation, it could dampen the aggressive growth trajectory for this sector.

- Multifamily: Apartment buildings have generally held value better than office or retail during the rate spike, thanks to strong tenant demand and rent growth. But multifamily is highly sensitive to interest rates for development and acquisitions– projects penciled at 4% financing don’t work at 7%.

If borrowing rates decline, expect a surge in multifamily investment activity and new construction as projects become financially feasible again. Cap rates for apartments could compress, reversing some of the price softening seen in the last few years. An added factor is the homebuyer market: high mortgage rates had been keeping more people in rentals, supporting apartment occupancy.

If rates drop and make homeownership more attainable, the multifamily sector could see a slight headwind as some renters choose to buy. Overall, moderate interest rates with steady job growth represent a sweet spot for multifamily performance.

In summary, interest rate trends are pivotal to CRE’s outlook under Trump. The industry is hopeful for a period of monetary easing that can fuel a rebound in property values and transaction volume. However, CRE leaders remain watchful for inflation or debt-market volatility that could disrupt this trajectory. Balancing growth initiatives with inflation control will be key. If successful, 2025 could mark the beginning of a renewed upcycle for commercial real estate. If not, the sector’s recovery may be bumpy.

Infrastructure Spending Plans and Implications for CRE Sectors

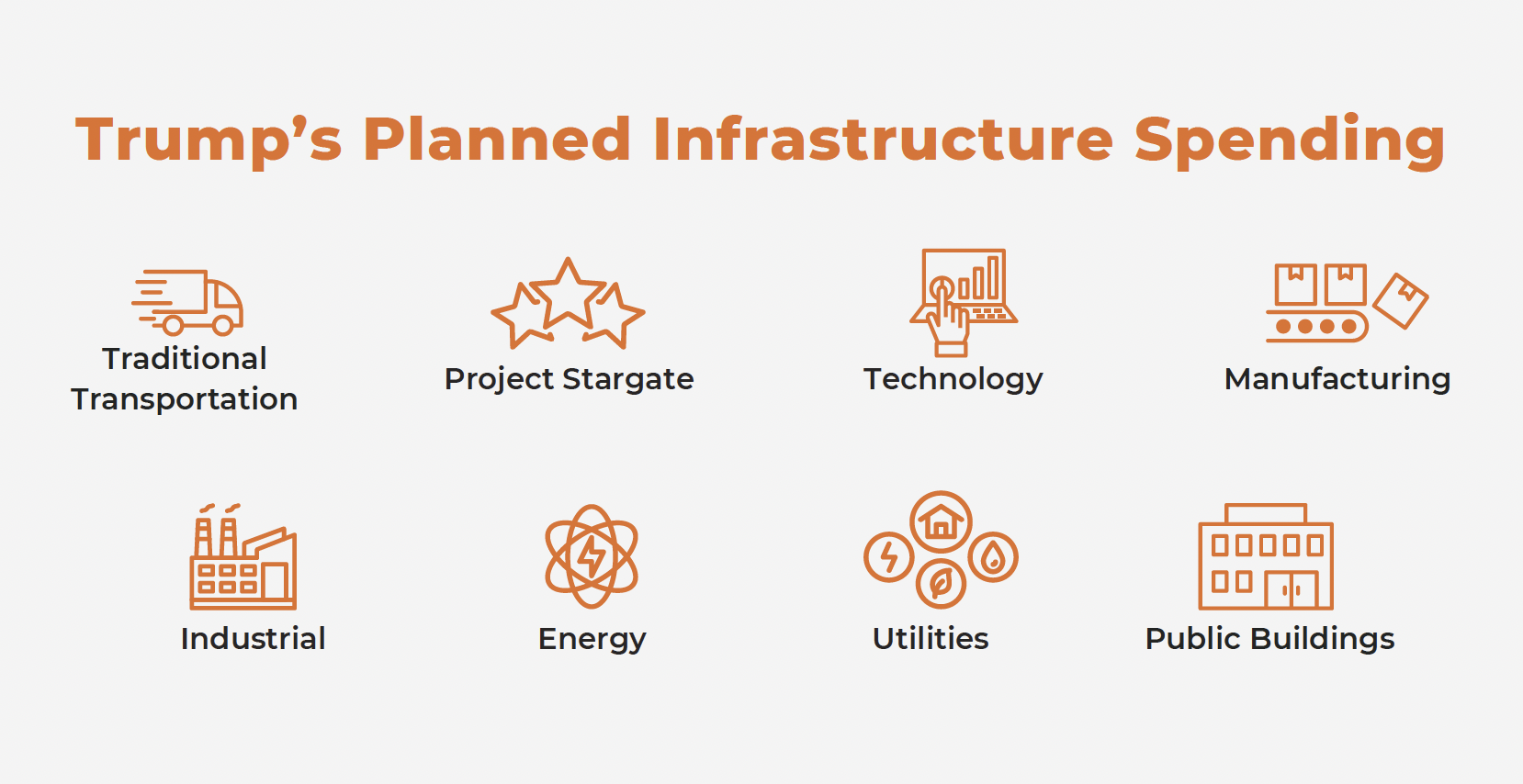

Trump campaigned on ambitious infrastructure investment, promising to rebuild America’s transportation networks and boost cutting-edge industries. This focus on infrastructure – from roads and bridges to telecommunications and energy – has far-reaching implications for commercial real estate. Infrastructure development not only creates construction jobs by stimulating local economies and demand for space, but can also alter growth patterns and property values by improving connectivity. Here are the major elements of Trump’s infrastructure vision and their impacts on commercial real estate:

Traditional Transportation Infrastructure

Expect a greater emphasis on roads, highways, and bridges over mass transit. With the existing $1.2 trillion Infrastructure Investment and Jobs Act from 2021 set to run through 2026, the new administration will have a chance to craft its own transportation bill. Early indications are that interstate highways will take precedence over projects like high-speed rail, aligning with Republican preferences to benefit rural and suburban areas. This focus means significant federal funding for highway expansions, interchange improvements, and bridge repairs.

- CRE Impact: Enhanced highway infrastructure can open up new development corridors. Industrial distribution facilities, truck terminals, and highway-adjacent retail, such as truck stops and service plazas, stand to gain from improved logistics efficiency and new locations becoming viable. For example, if a new beltway or interchange is built near a city, land that was previously inaccessible could turn into a hotbed for warehouse parks or big-box retail.

Office and multifamily sectors benefit more indirectly – shorter commute times and better regional connectivity can make certain suburban office markets or residential communities more attractive. However, prioritizing roads over urban transit may reinforce car-centric development patterns, potentially favoring suburban commercial projects, such as shopping centers, business parks and garden apartments, over urban core properties.

“Project Stargate” and Tech Infrastructure

A notable initiative announced is a massive investment in artificial intelligence and data center infrastructure. In partnership with private tech companies, Trump unveiled “Project Stargate”, aiming to channel up to $500 billion by 2028 into new data centers across the U.S., with an initial $100 billion already planned. The administration has committed to fast-tracking permits for these facilities and ensuring abundant energy supply to power them.

- CRE Impact: Data centers are a specialized segment of industrial real estate, and this initiative could supercharge demand in that sector. Even before the announcement, data center construction was one of the fastest-growing markets, with forecasts of 10–20% annual growth.

Now, regions with the right power infrastructure and fiber connectivity could see booms in data center development. This benefits not only data center operators and their investors, but also local economies. Each campus can bring construction jobs, high-paying tech jobs, and require ancillary office space for support functions.

Secondary effects include increased need for energy infrastructure projects, including power plants and grid upgrades, to support these centers, which in turn creates opportunities for construction firms and industrial contractors. Markets like Ashburn in Northern Virginia, Phoenix, Dallas, and others known for data centers are likely to see a surge in real estate activity and potentially higher land values due to the “Stargate” push.

Manufacturing and Industrial Development

Trump’s agenda includes bolstering domestic manufacturing through both tax incentives and infrastructure. The administration plans to expand tax breaks and streamline permits for new manufacturing plants, reinforcing the onshoring trend that began in recent years. Over $988 billion in private investment for U.S. manufacturing projects, such as chip fabs and EV battery plants, was announced in the past several years, and this momentum is expected to continue or accelerate under Trump.

- CRE Impact: A manufacturing renaissance directly drives demand for industrial real estate – from factories and assembly facilities to the warehouses and distribution centers that support production. Contractors are optimistic, with 25% of builders expecting more manufacturing construction in 2025 than in 2024, which was up 15% from 2023. Already, we’re seeing mega-projects like semiconductor fabs and electric vehicle plants breaking ground in states like Arizona, Texas, and Ohio. These projects typically require vast campuses and often attract supplier firms to locate nearby, creating industrial clusters.

For CRE, an uptick in manufacturing means growth in the industrial sector: lower vacancy and rising rents in markets that land major plants, as well as increased investment in warehouses, logistics hubs, and even workforce housing to support the employees.

Furthermore, if manufacturing expansion is coupled with “Buy America” policies for infrastructure, demand for warehouse space for materials and components could rise. One knock-on effect: onshoring manufacturing could elevate the need for “last-mile” distribution as more goods are made domestically and need storage and delivery, benefiting logistics real estate.

Energy and Utilities Infrastructure

The administration’s “energy dominance” approach promises heavy investment in traditional energy infrastructure – oil and gas drilling, pipelines, refineries, and power generation, including fossil fuels and nuclear. On day one, Trump used emergency powers to expedite energy projects, aiming to “drill, baby, drill” and remove hurdles like certain Clean Water Act restrictions. The goal is to increase domestic energy production, which includes building pipelines, export terminals, and possibly new nuclear plants. Additionally, as noted, providing power for the expanding data center footprint is a priority, likely spurring new power stations and grid upgrades.

- CRE Impact: Energy infrastructure projects can have localized effects on real estate. Regions rich in oil, gas, or mining, such as Texas, North Dakota and Appalachia, could see office and industrial demand uptick from energy companies expanding operations. For instance, more drilling activity requires more field offices, equipment yards, and worker accommodations in those areas.

Pipeline construction can be a boon for rural economies along the route, though the permanent real estate impact is smaller and more in the form of rights-of-way rather than buildings. If cheaper energy results through increased supply, manufacturing and chemical industries may further expand, indirectly lifting industrial real estate.

One specific angle is power plant and utility construction. Building a new generation of energy facilities, including possibly small modular nuclear reactors or natural gas plants, will create construction jobs and could stabilize electricity costs, benefiting energy-intensive property types like data centers and large commercial complexes. However, an emphasis on fossil fuels might slow investments in renewable energy infrastructure, which could affect real estate segments like solar or wind farm land leasing, which are less directly relevant to commercial real estate except for landowners and certain funds.

Public Buildings and Other Infrastructure: Although not as publicized, federal infrastructure spending can also extend to public buildings such as courthouses, government facilities, airports, ports, and water systems. Any large federal construction initiative could mean new government-leased office buildings or renovation of existing ones, impacting the office sector in markets with large federal footprints. Airport expansions or port upgrades would benefit industrial and hospitality real estate – industrial by improving trade capacity, and hospitality by increasing travel.

For example, a port deepening project can attract bigger cargo ships, driving warehouse demand nearby; an airport expansion can lead to more hotels and office space for airport-related businesses. Trump’s prior interest in privatizing air traffic control and leveraging private capital for infrastructure suggests Public-Private Partnerships (“P3”s) will be on the table. Successful P3 projects like LaGuardia Airport’s redevelopment are models the administration may follow. P3s could bring in institutional investors to fund toll roads, airports, and so-on, creating new types of real asset investment opportunities alongside traditional CRE.

Opportunities For Commercial Real Estate

The infrastructure push is broadly stimulative for the economy and thus beneficial for commercial real estate demand. In the near term, construction and engineering firms will hire, filling offices and boosting local apartment occupancy where projects are located. Contractors are already gearing up for increased activity in sectors like data centers, power, and manufacturing. One principal contractor noted that data center construction was a top growth area even pre-announcement and that there’s still a tremendous amount of opportunity in this sector.

For the industrial sector, infrastructure investment is an unambiguous positive. Better transportation networks and onshored manufacturing translate to higher utilization of industrial spaces and new development prospects. Retail may also get a lift; infrastructure jobs put money in workers’ pockets, who then spend at local shops and restaurants.

Furthermore, improved infrastructure can enhance property values: real estate near new infrastructure such as a new transit station, highway exit, or rebuilt downtown street often appreciates as accessibility improves. If the administration ties some infrastructure funding to housing– rewarding cities that allow more apartments, for instance– that could spur multifamily construction in high-demand areas, which would be a boon for apartment developers and investors. Overall, infrastructure spending acts as a form of fiscal stimulus that can buoy occupancy and rent growth in multiple commercial real estate sectors, assuming it’s executed efficiently.

Risks and Challenges For Commercial Real Estate

Ambitious infrastructure plans face several hurdles that could temper their positive impact. Execution risk is high; large projects often run into delays, cost overruns, or political opposition. The construction industry is already grappling with skilled labor shortages and rising material costs. Injecting a wave of new projects could further strain labor availability and push wages up, which might then inflate development costs for private real estate projects. Contractors may charge more as demand for their services spikes. Moreover, if protectionist trade measures make materials like steel and lumber more expensive (see Trade Policies section), infrastructure projects themselves become costlier, meaning fewer projects for a given budget.

There’s also the question of funding. Trump’s plan will likely rely on a mix of federal spending, private investment (P3), and perhaps state/local contributions. Budget constraints or political fights in Congress could scale back the scope of these investments. If deficit hawks balk at massive spending, infrastructure could roll out slower or smaller than promised.

From a CRE perspective, another risk is that not all infrastructure is equally beneficial. For instance, a highway that enables suburbanization might draw people and businesses away from central city real estate, impacting urban office or retail occupancy negatively. Additionally, the heavy focus on highways and fossil-fuel energy may bypass green infrastructure. Some investors worry this could set back city-focused transit-oriented development and climate-resilient infrastructure upgrades that in the long term enhance property sustainability.

In summary, while infrastructure plans present tremendous opportunities for growth, CRE stakeholders should monitor how these projects are prioritized and executed, and be prepared for short-term disruptions, such as labor/material bottlenecks, that could come with the construction boom.

Trade Policies and Tariffs: Effects on Industrial Real Estate and Foreign Investment

One of the most radical shifts under the Trump administration is the return to protectionist trade policies, including sweeping tariffs. Trump has proposed aggressive import tariffs as a signature economic policy, aiming to boost domestic industry and reduce trade deficits. These trade measures have significant implications, especially for the industrial real estate sector, which is closely tied to global supply chains and manufacturing, and for foreign investment flows.

Proposed Tariff Regime: The new administration is considering tariffs at a scale not seen in decades. While Trump’s plans in this area seem to fluctuate daily, he has floated the idea of a universal baseline tariff of 10–20% on all imports from countries around the world. In addition, specific targets include a 25% tariff on imports from neighbors Mexico and Canada, which went into effect in early March 2025, and massive tariffs on many Chinese goods.

During Trump’s first term, tariffs were applied to about 10% of U.S. imports, focusing on specific categories, namely steel, aluminum, solar panels, washing machines, and many Chinese products. The difference now is the tariffs could become broader and more generalized. Advisors have discussed possibly phasing in these tariffs or using exemptions for vital goods, but the overall direction is toward a much more protectionist stance.

Macroeconomic Effects: Across the economy, these tariffs are expected to raise costs for imported goods, contributing to higher inflation. Many companies have already signaled they will pass on increased import costs to consumers. This could dampen consumer spending and slow economic growth, if not offset by other measures. Economists and even conservative analysts caution that such tariffs are unlikely to spark a manufacturing renaissance by themselves but will certainly feed into prices and potentially interest rates. There’s also the risk of retaliatory tariffs from trading partners, which could hurt U.S. exporters, agriculture and manufacturing export in particular. All these factors introduce uncertainty that weighs on business investment decisions, including real estate development tied to trade-oriented industries.

Impact on Industrial Real Estate: The industrial sector– warehouses, distribution centers, and manufacturing facilities– is on the front lines of trade policy changes. The last round of tariffs, from 2018 to 2019, provides some guidance: U.S. imports from China dropped sharply; China’s share of U.S. goods imports fell by nearly nine percentage points since 2017, while other countries like Mexico and those in Southeast Asia picked up market share. In fact, Mexico is now the U.S.’s largest source of imports, benefiting from nearshoring trends.

Despite initial fears, the industrial real estate market proved resilient during the trade war. Warehouse demand exceeded expectations in 2017 and 2018, with net absorption higher than forecast, and vacancy rates stayed near record lows through 2019. One reason was a strong U.S. consumer and the rise of e-commerce, which kept goods flowing. Another was that companies adapted; many diversified their supply chains, moving production to tariff-exempt countries or shipping smaller packages direct to consumers to minimize duties. Some firms began stockpiling inventory to buffer against supply shocks, which increased the need for warehouse space as safety stock storage. These adaptive behaviors blunted the negative impact on industrial real estate.

Opportunities for the Industrial Sector

In the long run, high tariffs could accelerate the trend of onshoring and near-shoring manufacturing. To avoid hefty import taxes, more companies may opt to make products in the U.S. or in nearby countries like Mexico. This would drive new demand for manufacturing facilities and distribution centers domestically. As real estate investment firm Clarion Partners notes, we might see a surge in U.S. manufacturing investment and continued growth for logistics real estate as companies reconfigure supply chains.

Domestic factories require not just production space, but also warehouses for raw materials and finished goods, so industrial developers could see increased activity. Furthermore, regions like the U.S.–Mexico border, inland port cities, and Southeast U.S., which are closer to alternate import sources, stand to gain. For example, increased trade via Mexico has boosted investor interest in markets like El Paso, TX. Another possible positive is that tariff uncertainty encourages holding extra inventory, meaning retailers and manufacturers lease more warehouse space as a buffer, which supports industrial occupancy.

Challenges for the Industrial Sector

In the short term, the transition pains of shifting supply chains could cause dislocations. Ports that rely on Chinese imports, like Los Angeles/Long Beach, might see volumes fall, potentially softening warehouse demand in those markets, at least until other trade lanes, like Southeast Asia, and India, scale up to replace the volume. Tariffs also raise the cost of construction materials for industrial projects, such as steel for building frames and imported machinery, potentially slowing down the pipeline of new warehouse construction due to higher costs. If trade tensions spark a broader economic slowdown, overall freight volumes could decline, which would directly hit logistics property usage.

Additionally, while some manufacturing will return, not every industry can feasibly move production, so certain goods might just become more expensive. Inflation and interest rate impacts from tariffs (as discussed earlier) could indirectly hurt industrial real estate by increasing capitalization rates since investors require higher returns if inflation is high, which would put downward pressure on property values. In essence, the industrial sector benefits from the strategic reordering of supply chains but is not immune to the macroeconomic headwinds tariffs create. Clarion Partners assesses that the net risk of drastically higher tariffs is mostly negative for the economy due to retaliation and uncertainty, even if industrial real estate finds ways to adapt.

Impact on Retail Real Estate

Retail is another sector that feels trade policy acutely. A large portion of consumer goods – from clothing to electronics to furniture – are imported. Tariffs on these products act like a tax on retailers and shoppers. Major U.S. retailers have already indicated that price hikes are likely as import costs rise.

For brick-and-mortar retail properties, this creates a risk of softer sales and tenant instability. If retailers raise prices, consumers might cut back spending or shift more to discount and online channels. Stores could see lower foot traffic, making it harder for landlords to sustain rents or fill vacancies. Segments like apparel or electronics stores, which are heavily dependent upon imports, are most vulnerable. In addition, many building materials for maintenance of retail centers, including lighting, HVAC systems, and flooring, are imported, so operating costs for property owners could inch up, squeezing net operating income.

On the opportunity side, should tariffs successfully drive more domestic production of consumer goods, in theory it could shorten supply chains and get products to stores faster, but any such benefit is likely minor compared to the cost impact. Another angle: if trade policies end up protecting certain U.S. industries– say, American-made furniture or textiles– retailers specializing in those goods might thrive and expand stores. Overall, retail real estate owners will be watching consumer sentiment and spending power closely. Tax cuts might put more money in consumers’ hands, but tariffs take it away via higher prices, so the net effect on retail sales– and thus retail space demand– is uncertain.

Impact on Office Real Estate

The office sector is not directly targeted by tariffs, but global trade policies can affect the white-collar economy in indirect ways. If export industries like manufacturers, tech companies, and agribusiness are hurt by retaliatory tariffs, they may cut back on expansion or hiring, reducing office space needs in certain markets; for example, export-heavy cities like Seattle or Houston could see impacts. Conversely, if some industries like defense manufacturing or domestic-focused manufacturing grow due to protectionism, their headquarters and back-office operations might expand, increasing office demand in those niches.

By and large, the office market’s bigger issues are oversupply and remote work, which trade policy won’t fix. However, one specific area to watch is foreign investment in U.S. office buildings. In past years, a significant portion of trophy offices in cities like New York and San Francisco were bought by foreign investors, including Chinese, Middle Eastern, and European funds. Heightened geopolitical tensions and trade disputes might lead some foreign capital to retreat or redirect.

In fact, Chinese investors have largely pulled back from U.S. commercial real estate since the first trade war; Chinese direct investment in U.S. properties fell over 80% from 2017 to 2018, driven by both Beijing’s capital controls and the uncertain U.S.-China relations. If the U.S. and China remain at odds, or if new restrictions on Chinese investment are enacted as part of national security measures, we can expect continued low Chinese investment in U.S. office and commercial assets. Investors from allied countries such as Canada, Europe, Japan, and South Korea may fill some of the gap, but they too evaluate political risk. A fragmented global trade environment could make all cross-border investors a bit more cautious, potentially reducing the pool of buyers for high-end commercial properties.

Foreign Investment and Capital Flows

Beyond just office, foreign investment in all U.S. real estate could be influenced by trade and foreign policy. The U.S. has long been a magnet for global capital due to its stable legal system and strong property rights. Under Trump, if the U.S. economy grows solidly, boosted by tax cuts and internal investment, and other regions falter, some foreign investors will still view U.S. real estate as a safe haven and we might see increased interest from certain foreign buyers. For instance, sovereign wealth funds from oil-rich nations might have more capital with higher oil prices (if energy policies drive up prices) and choose to park some in U.S. real estate. On the other hand, a climate of trade conflicts and tariffs can also breed uncertainty that makes investors hold back.

There’s also the risk of currency fluctuations. Tariffs tend to strengthen the U.S. dollar by making imports pricier, improving the trade balance or through monetary reactions. A stronger dollar makes U.S. real estate more expensive for foreign buyers in their local currency, which can dampen demand.

Foreign direct investment (“FDI”) in industrial projects is another consideration. Companies from abroad might decide to build factories in the U.S. to circumvent tariffs, which is beneficial to industrial real estate, but some may also choose to invest in other countries if they feel the U.S. is too protectionist. For example, as noted, some Chinese firms responded to tariffs by investing in logistics and assembly in Mexico to serve the U.S. market tariff-free. That’s foreign investment happening in North America, but not in the U.S. If such workarounds become common, the U.S. could miss out on some industrial FDI that goes to tariff-friendly jurisdictions.

Summing up – Commercial Real Estate Risks vs Opportunities

Trump’s trade policies carry substantial downside risks for CRE, chiefly through the prospects of higher construction costs, inflation, and broader economic drag. The industrial sector, however, could find a silver lining as companies re-shore production and retool supply chains, leading to new facility construction and potentially higher demand for logistics real estate to support domestic manufacturing. The geography of industrial demand may shift: inland distribution hubs, port cities outside the West Coast, and Mexican border regions may flourish, whereas some coastal import-reliant markets could see a relative slowdown. Foreign investor behavior will likely bifurcate, with some retreating in the face of U.S. protectionism, and others seeking opportunities in the dislocation.

CRE professionals should be prepared for a period of volatility. Clarion Partners notes that tariff levels, timing, and impacts are highly uncertain, and policies could be adjusted on the fly. Contingency planning, such as sourcing alternative materials, hedging interest rates, and targeting emerging growth markets, will be key for navigating this trade policy landscape.

Outlook by Property Type and Final Thoughts

All major commercial property types will feel the effects of the Trump administration’s policies, albeit in different ways. Below is a brief outlook for each sector, integrating the policy influences discussed:

Office: The office sector faces persistent structural challenges from remote work, which policy changes only marginally address. On the opportunity side, a pro-business climate with tax incentives could drive job creation and corporate expansions, helping office demand in select markets. High-quality office buildings may attract tenants seeking to upgrade, especially if the economy strengthens. The administration’s support for converting obsolete offices to housing via proposed tax credits is a positive development for the sector’s long-term health; it offers an exit strategy for owners of chronically vacant offices and helps reduce oversupply.

Risks for office include rising operating costs, such as energy and materials, if tariffs and deregulation lead to higher utility prices or deferred maintenance. Additionally, if federal government agencies downsize their office footprints– a trend that could continue under efficiency mandates– markets with large federal leases could see vacancies.

Overall, office recovery will be slow, but strategic policy measures like urban revitalization programs and sustained economic growth could stabilize the sector. Investors are advised to focus on adaptive reuse opportunities and prime assets in strong locations, while being cautious with secondary assets until demand recovers.

Retail: The retail real estate sector enters this era on improved footing post-pandemic as many weak retailers already shuttered, and surviving stores often serve omni-channel roles. Trump’s policies produce mixed conditions for retail. On one hand, tax cuts could boost disposable incomes, and infrastructure/jobs investment could raise consumer spending power, which would support retail sales and expansions. If employment stays high and wages grow, retailers in sectors like home improvement, dining, and services could lease more space; we’ve seen discount and dollar store formats expanding even in uncertain times.

On the other hand, trade tariffs pose a serious headwind because higher prices on imported consumer goods act like a sales tax, potentially curbing consumer purchasing. Retailers might struggle with slimmer margins or pass costs on to shoppers, dampening demand. Inflation worries could also push interest rates on consumer credit and mortgages back up, hurting big-ticket retail categories. Additionally, deregulation might reduce some costs– simplified labor rules or tax relief for small businesses, for example– but if it also undermines confidence– say, through market instability– that could offset retail gains.

The net outlook for retail: cautiously optimistic for essential and experience-based retail that benefit from economic stimulus, but watchful of price-sensitive segments. Well-located grocery-anchored centers and outlets catering to everyday needs should remain solid. Retail real estate owners will need to stay agile in managing tenant mix and might consider incorporating non-retail uses like healthcare, entertainment, and even micro-fulfillment for e-commerce to keep properties resilient.

Industrial: Industrial real estate is widely viewed as a winner under Trump-era policies, with some caveats. The combination of tax incentives for manufacturing, robust infrastructure spending, and supply chain reorientation away from China bodes extremely well for U.S. industrial demand. Warehouses and distribution centers serving e-commerce and domestic consumption should continue to see high occupancy and rent growth. Modern logistics facilities in port markets, inland hubs like Chicago or Atlanta, and border zones in Texas and Arizona are likely to attract both tenants and investors. Industrial development could pick up pace if material costs stabilize, given strong fundamentals – although developers must monitor steel and import costs due to tariffs.

One potential risk is if global trade frictions escalate to the point of dampening overall trade volumes or causing a recession, which could slow cargo flows and warehouse leasing. Another risk is overbuilding. The sector’s success has led to a lot of new supply. A misjudgment in demand —for example, if companies overstock and then cut back, or if consumer spending falters– could lead to a temporary glut.

But on balance, industrial real estate is positioned to remain the standout sector, especially as experts predict continued strong demand for warehouses in 2025, and any manufacturing uptick will only add fuel to that engine. Investors from around the globe are keen on U.S. industrial assets for their stability and growth, and that should persist, barring an extreme trade war scenario.

Multifamily: The apartment sector remains one of the most robust in commercial real estate, supported by housing shortages and demographic trends. Under the new administration, multifamily could see both heightened development opportunities and some financing challenges. The push to ease zoning and cut regulations is aimed at boosting housing construction, which could lead to more multifamily projects in supply-constrained markets. Incentives like Opportunity Zones and potential infrastructure-linked housing grants encourage investment in new apartments, particularly affordable and workforce housing. Additionally, if the economy grows and job formation is solid, that creates new households (renters), bolstering demand.

However, financing costs and mechanisms bear watching. If Fannie Mae and Freddie Mac withdraw a bit from the market due to privatization, borrowing for apartments could get pricier, especially for affordable housing initiatives. This might be partly offset by banks stepping up or new private lending channels, but it introduces uncertainty.

On the flip side, any significant drop in interest rates will quickly flow to lower multifamily loan rates, likely spurring a refinance wave and additional investment. Rental demand should remain strong as long as homeownership is expensive. Even if mortgage rates dip, high home prices and limited starter home supply mean renting will stay the norm for many young adults.

Risks for multifamily include construction cost inflation– tariffs on construction materials like lumber, if re-imposed, can raise apartment development budgets– and potential policy changes in specific markets. For example, rent control or tenant protection laws at state and local levels could be influenced by the broader political climate. Also, an immigration clampdown could slow population growth in some regions, slightly dampening housing demand.

Yet, multifamily is often viewed as a relatively safe asset class in uncertain times — people always need housing. As such, investor appetite for apartments is expected to remain high, particularly if other sectors like office are seen as riskier.

Final Takeaways

The new Trump administration ushers in a complex mix of pro-growth initiatives and disruptive policy shifts. For commercial real estate participants, the environment will require careful navigation but also offers considerable upside if strategies align with policy trends. Here are a few closing insights:

- Prepare for Policy Volatility: Many proposals – from tax laws to tariffs – will be debated and may evolve. CRE leaders should stay informed about the latest developments on Capitol Hill and in trade negotiations. Scenario planning is crucial: savvy firms are already running models on how a 10% tariff vs a 30% tariff scenario might affect their construction costs or tenant operations. Being caught flat-footed by a new law could be costly, so proactive monitoring and engagement with industry advocacy groups like real estate roundtables and trade associations is advised.

- Long-Term Perspective with Agility: Despite the political changes, real estate is inherently a long-term asset class. Investors should stay focused on long-term growth and remember that CRE performance has historically shown no strict correlation with which party is in power. Fundamentals like location, population growth, and job creation will remain paramount. That said, the next few years may see rapid shifts, such as interest rate moves and regulatory changes, that require agile decision-making. Flexibility – in lease structures, investment timelines, and capital stacks – will be an asset.

- Leverage Opportunities, Mitigate Risks: There are clear areas of opportunity: take advantage of tax incentives like bonus depreciation, Opportunity Zones, and potential new credits while they last, as these can significantly boost project returns. For example, a developer might fast-track a project to utilize 100% expensing if that comes back. Similarly, positioning portfolios to benefit from infrastructure growth, such as owning industrial land near proposed highway projects or data center clusters, could yield outsized gains. Concurrently, plan for headwinds: higher operating and construction costs should be underwritten into budgets given tariff and wage inflation possibilities. Consider hedging interest rates or locking in financing early, if favorable, to guard against rate volatility. Diversify tenant mixes to cushion against consumer spending swings or supply chain disruptions.

- Expert Forecasts: Industry forecasts for 2025 and beyond suggest a cautiously optimistic outlook for CRE. Analysts predict a modest rebound in 2025 for commercial real estate overall, assuming interest rates trend downward and the economy avoids a recession. Industrial is slated to lead in performance, with multifamily not far behind, while retail and office recover more slowly. However, the risks remain pronounced. Inflation could flare up, or geopolitical events could intervene. Being optimistic does not mean being oblivious to risks; it means recognizing the potential for upside while guarding the downside. Many experts are essentially saying that the pieces are in place for a real estate revival– cheap capital, pro-investment policies, pent-up demand– but execution and external factors will determine the degree of success.

In conclusion, commercial real estate faces a dynamic landscape under the Trump administration. Tax cuts and deregulation are largely positives that can boost investment returns and development activity. Infrastructure spending promises to drive growth in sectors like industrial and to revitalize communities –- a rising tide that can lift many boats in the property market. Yet, countercurrents from protectionist trade policies and potential inflation/interest rate fluctuations introduce caution.

Commercial real estate professionals should balance optimism with vigilance, capitalizing on policy-driven opportunities while remaining mindful of the macroeconomic and operational risks. By staying informed and adaptable, the commercial real estate industry can thrive even amid the uncertainties of this new political era, continuing to find creative ways to meet space needs and deliver value to investors and communities alike.

Updates on Trump Policies’ Impacts on CRE

Based upon President Trump’s tumultuous, controversial first two months in office, it’s likely that his administration’s fiscal, trade, taxation and immigration policies will be very fluid and even inconsistent over the next four years. All are likely to change continually and without warning as Trump and his advisors see fit and the US and world economies, all sectors of commercial real estate and capital markets will react accordingly, for better or worse.

Since those constant and unpredictable policy changes will have such a profound impact on commercial real estate investment and development, we intend to follow them closely and provide regular updates and analysis on the Realogic blog, so check back here often to stay well informed.

Meanwhile, while we all anxiously and eagerly wait for Trump’s economic and geopolitical policies to take more definitive shape and a clearer picture of the opportunities and challenges ahead for commercial real estate to emerge, we have some additional resources on our website that might be of help and interest to you, including:

- A comprehensive six-part series on due diligence best practices, to help you thoroughly and accurately assess properties

- Two posts on Argus Enterprise best practices—modeling general vacancy and modeling market rent inflation—and a post offering one simple tip to dramatically improve your Excel models

- Several posts on the office sector, which is attracting attention from investors again, including how RTO mandates and tenant amenities are helping stabilize office vacancies and how proptech is revolutionizing office operations and boosting profits

Best-In-Class Services, Support and Solutions

Whatever the next four years bring and how it affects commercial real estate, Realogic can help you adapt, adjust and achieve your financial goals. Whether your investment strategy ultimately ends up being aggressive, cautious or somewhere between, and regardless of which asset classes you end up targeting, we offer a wide range of commercial real estate services, support and solutions to help you maximize your returns, lower your costs, tap into our unmatched commercial real estate skills and expertise and make smart, profitable, informed decisions. These include:

- Underwriting

- Due Diligence

- Financial Modeling

- Lease Administration

- Lease Abstraction

- Loan Abstraction

- Closing Support

- Qualified Opportunity Zone Assistance

- Non-Performing Loans and Distressed Assets

For more information, contact us at info@realogicinc.com or 312-782-7325

About The Author

Mike Phelps is Realogic’s General Counsel. Mike has over 20 years of commercial real estate experience, including with financial modeling and analysis, analysis of acquisitions and dispositions, due diligence, underwriting, development and review of financial proformas and Argus/Dyna training. In his current role, he supports each of Realogic’s business lines and provides counsel on corporate, employment and compliance issues. He is also responsible for negotiation of contracts, master service agreements, software licenses and subscriptions and other intellectual property matters. Mike welcomes your comments on his post. He can be reached at mphelps@realogicinc.com