See Our Ready to Use Excel Model for Commercial Real Estate Development in Action

As they say, seeing is believing, so we created a fast-moving, two-part product tour of our ready to use Excel model for commercial real estate development so you can see many of its sophisticated features and its powerful functionality in action for yourself.

Part 1 of Our Excel Model Product Tour

- Flexibility, versatility and scalability

- Wide range of functionality

- Clean, streamlined architecture

- Intuitive, modular structure

- Transparent formulas

- Simplified variable and inputs

Our Excel Model for Commercial Real Estate Development is Flexible and Versatile

Combined with our supplementary modules, our base commercial real estate development model can be used to model 16 different types of commercial real estate assets, including:

- Office

- Retail

- Industrial/Warehouse

- Multi-Family

- Multi-Family-Condos

- Multi-Family-Condos- With Renovations

- Single-Family Build For Rent

- Student Housing

- Student Housing-Condos

- Student Housing-Condos-With Renovations

- Hotels/Condos

- Parking

- Marinas

- Lot Sales

-

- Data Centers

- Mixed-use developments

Our financing modules include:

- Construction and permanent debt

- Equity/Partner returns and distributions

- Customized Promote Crystallization

In addition, we offer a module for development asset management, which tracks actuals for the project.

Part 2 of Our Excel Model Product Tour

- Costs: our model allows users to have unlimited expense lines and to categorize costs four different ways– as acquisition, hard or soft costs and financing.

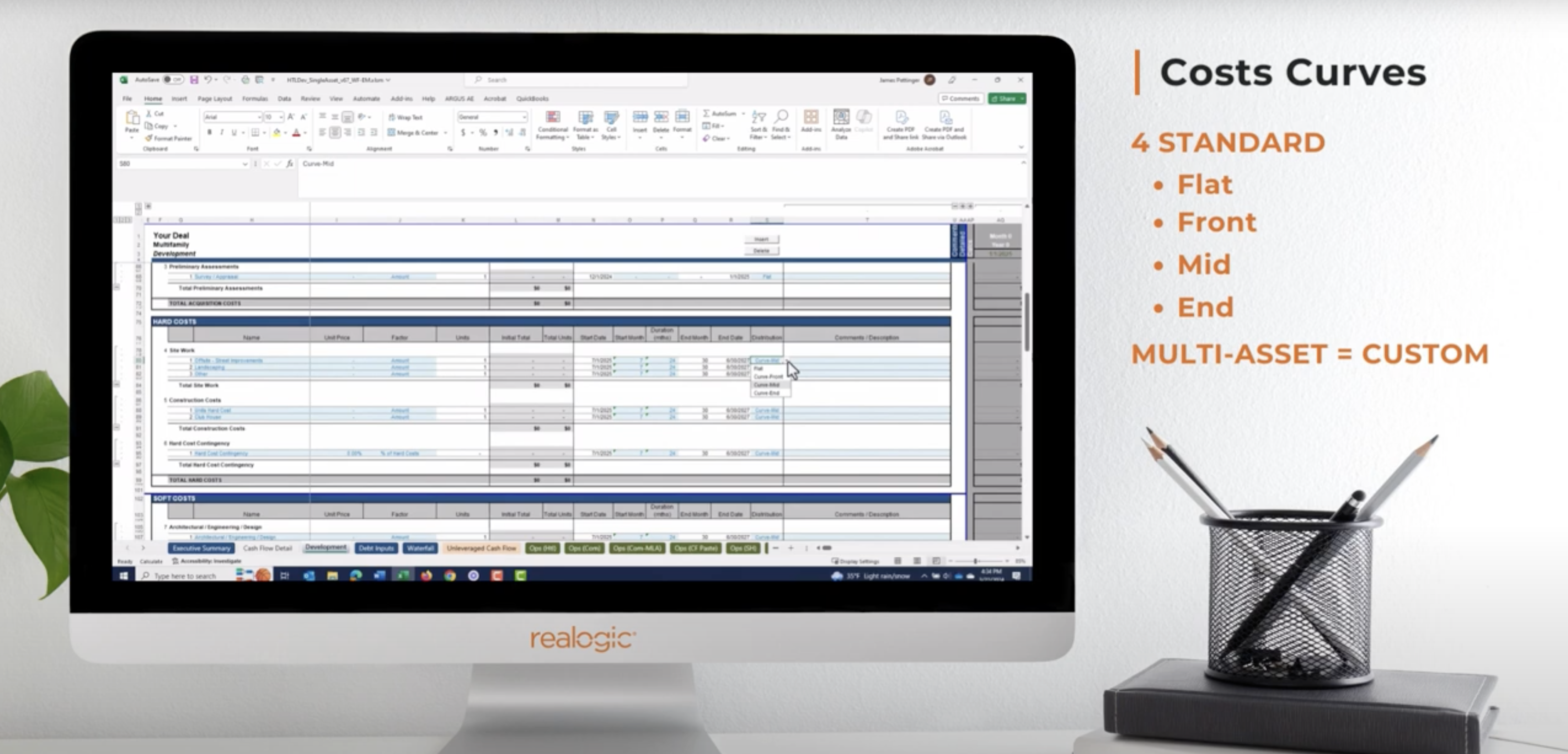

- Cost Curves: there are four standard cost curves in the model. The multi-asset/multi-phase version allows users to set up customized cost curves.

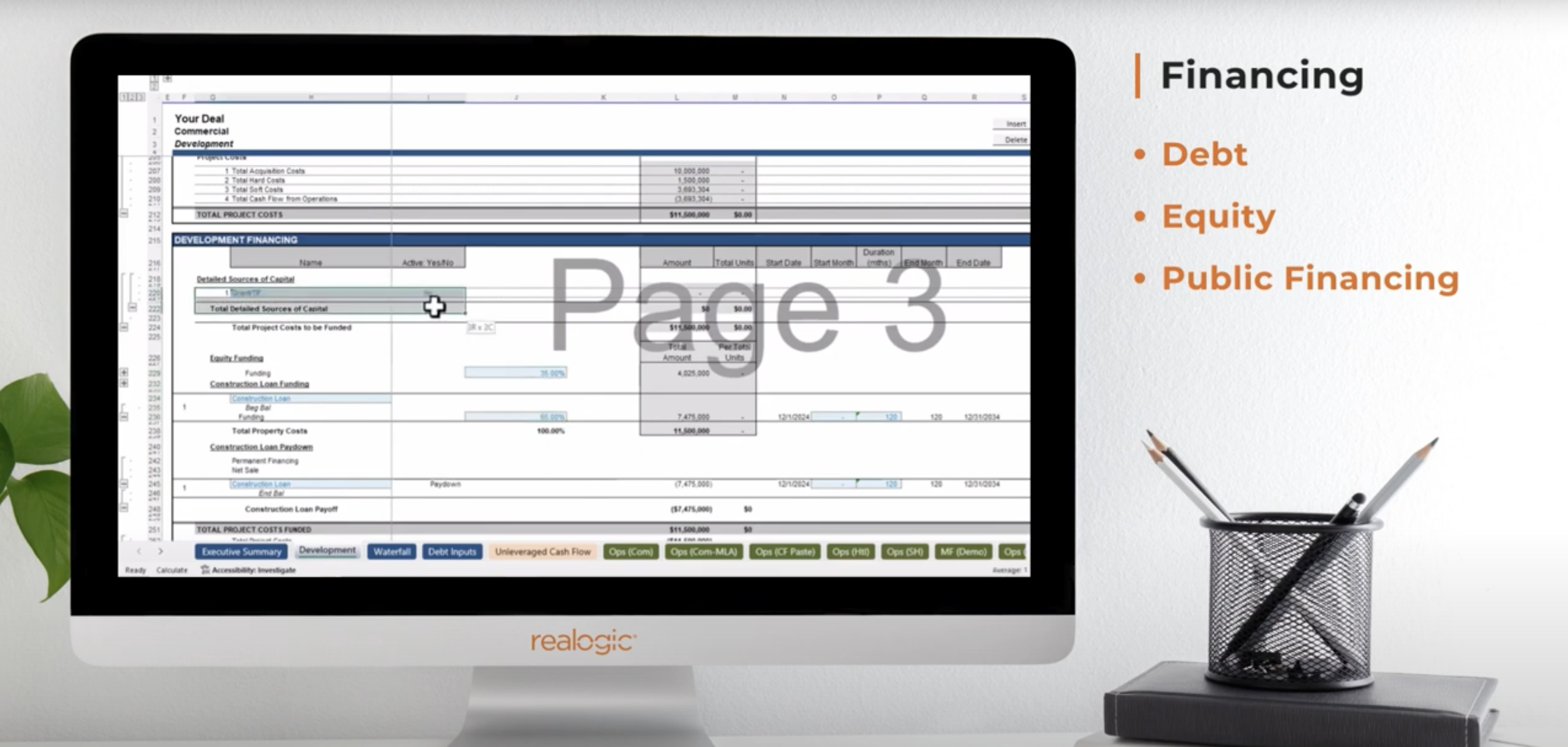

- Financing: can be categorized as direct—which in turn can be categorized as debt or equity, earns returns and is paid back from the project—or indirect, which comes from external sources like TIFs and grants.

- Reporting: Our model generates a detailed and comprehensive executive summary that includes deal inputs, timing, sources and uses, cash flows and partner or project-level returns. It also generates supporting reports that detail cash flows, budgets and returns on an annual and monthly basis.

- Reusable Data Elements (RDEs): RDEs allow users to define an object once, then use it throughout the model, saving time and reducing errors.

Excel Models for Commercial Real Estate Development and Acquisitions

Realogic offers out-of-the-box Excel models for commercial real estate development and acquisitions. Both of our models were designed and built by our team of financial modeling experts, and they have been tested and fine-tuned over the course of 30+ years and thousands of successful commercial real estate projects of all types and size.

Our Excel models for commercial real estate development and acquisition are easy to learn and use and can help anyone in commercial real estate model their projects faster, easier and more accurately. Using our proven, reliable Excel models instead of trying to build your own will save you countless hours of work, eliminate guesswork and trial and error and give you greater confidence in the accuracy, integrity and consistency of your numbers.

Customize and Integrate Our Commercial Real Estate Models

While our Excel model for commercial real estate development is ready-to-use, we can customize it for you if you need. Or, if you’re happy with your own Excel development model and are looking to supplement it, our model can quickly and easily be integrated with yours.

Learn More

If you’d like more information on our built Excel model for commercial real estate development or would like to see a live, full-length demo, contact us at info@realogicinc.com or 312-782-7325